Transactions with digital wallets increase 530% in Chile

The Wild West of E-commerce. Tips For VCs With Struggling Portfolio Companies. Bootstrapping is back. Invest in the transfer market of professional soccer players.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

Transactions with digital wallets increase 530% in Chile

The use of digital wallets in Chile has grown by 530% following the launch of Apple Pay and other payment options like Google Wallet, Fitbit Pay, and Garmin Pay.

The increase in digital wallet usage is attributed to an improved payment experience and the adoption of digital wallets aligning with global trends. Debit card usage increased by over 1,000% and credit card usage increased by over 260%.

The total use of digital wallets saw a growth of 420% in terms of sales volume. This growth is attributed to the use of digital wallets on Transbank devices like phones and smartwatches, which has also increased the utilization of NFC technology in Chile.

Vía Contxto

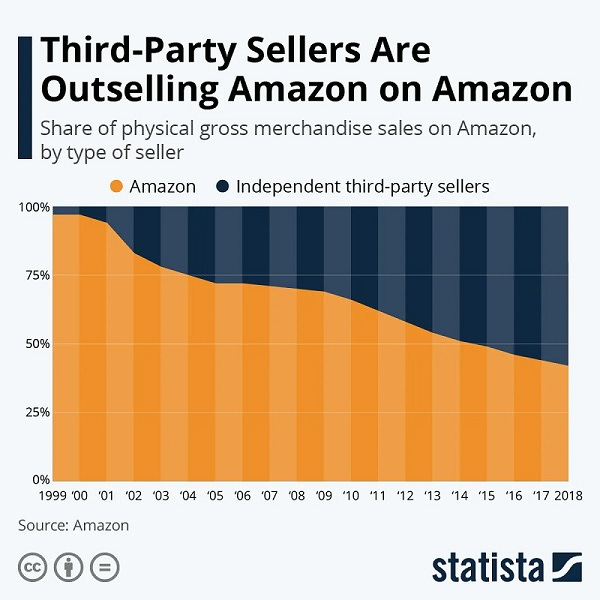

The Wild West of E-Commerce

This article discusses the role of technology in shaping commerce and highlights the recent IPO of Klaviyo, a platform that provides personalized marketing automation for small and medium-sized businesses.

The article also mentions other invisible but influential companies in the commerce space, such as Amazon, Shopify, and Faire. It explores the concept of platforms in commerce and the importance of data, distribution, and development in driving network effects.

The author then presents a simplified diagram of the flow of commerce, focusing on customer acquisition, the customer experience, and the checkout process. The article concludes by mentioning TikTok's entry into the commerce space and its aim to compete with Amazon during the holiday season.

Vía Digital Native

Quick News

Mercado Pago and Win Investments achieve soccer player transfers

Mercado Pago and Win Investments have partnered to allow anyone to invest in the transfer market of professional soccer players through the sale of tokens.

Value proposition. The tokens represent ownership rights in players and offer a new way for fans to participate in the football industry. The first sale of a token has been successfully completed, generating significant revenue for the participating football club.

Be a shareholder in the transfer market. This partnership aims to democratize financing and expand investment opportunities in football. Investors who hold tokens will receive a share of the profits when a player is transferred. This collaboration provides a unique opportunity for fans to become shareholders in the transfer market. (Contxto)

Lemon Integrates OnRamper to Allow 5 Latam countries to Buy Crypto in their National Currencies

Cryptocurrency platform Lemon has partnered with OnRamper, an aggregator of conversion services, to allow users in five Latin American countries to purchase cryptocurrencies using their local currency

Value proposition. The collaboration offers flexibility in payment options, including debit cards, credit cards, and bank deposits. However, selling cryptocurrencies and converting them to local currency is not currently available.

Business model. Lemon aims to make cryptocurrencies more accessible by integrating OnRamper and allowing users to invest and participate in the Web3 environment using familiar payment methods. Lemon also enables users to generate cryptocurrency income through "Lemon Earn." (Contxto)

FEMSA announces VP of Nubank to lead its digital business

Mexican conglomerate FEMSA has appointed Juan Carlos Guillermety as the new head of its digital division. This move comes as FEMSA undergoes a review of its operations and focuses on its digital business, including the financial product Spin

Who is Juan Carlos Guillermety? Guillermety previously worked at Nubank and Visa, bringing experience in product and innovation. FEMSA aims to increase its user base and develop revenue-generating products in the digital space.

FEMSA’s digital business review. FEMSA aims to increase its user base and develop revenue-generating products in the digital space. The company plans to establish an ecosystem that integrates Spin, a rewards program, and a B2B division. FEMSA recently acquired payment aggregator Netpay and continues to be led by CEO José Antonio Fernández Carbajal. (Contxto)

Nubank exceeds IFC’s expectations and receives USD$265 million

Brazilian digital bank Nubank has announced a significant increase in the loan granted by the International Finance Corporation (IFC) from USD$150 million to USD$265.1 million.

The funds. The additional funds will boost Nubank's operational growth and expand access to its financial services in Colombia.

Nubank’s highlights. Nubank has already reached over 700,000 customers and has seen significant revenue growth in the first quarter of 2023. The bank has over 80 million customers, with the majority in Brazil. (Contexto)

Nubiral invests USD $1 million in Generative Artificial Intelligence

Nubiral, a global technology company, has announced its commitment to invest $1 million annually in its Generative Artificial Intelligence (GAI) professional excellence center.

The center. The center, which already has a team of experts, focuses on implementing AI projects for clients in various industries.

Nubiral plans. Nubiral plans to triple the size of the center by 2024 and aims to support organizations in adopting AI technology. The company's investment aligns with the projected increase in AI system investments globally. (Contxto)

Liquido seeks to implement a WhatsApp payment system in Mexico

Liquido, a fintech firm based in California, is focusing on strengthening its presence in Mexico, considering it a strategic market.

Value proposition. The company aims to simplify user processes and plans to implement a payment system through WhatsApp. Liquido offers a comprehensive payment solution for various transactions and has already processed over $350 million in payments during its beta phase in Mexico.

Business model. The company aims to surpass $5 trillion in processed payments by 2024. Liquido also prioritizes security and compliance with the highest payment industry standards. The total value of digital commerce in Latin America is expected to increase by 73% by 2025. (Contxto)

Grupo Bimbo launches call to collaborate with startups on its innovation platform

Mexican corporation Bimbo has launched an open innovation platform called Open Door, inviting startups to participate.

The program. The program focuses on the biscuit and bar segment and offers selected startups mentorship, access to global infrastructure, and the chance to present pilot projects to Bimbo executives.

What's Bimbo looking for. The first edition saw 11 startups from 7 countries successfully participate. Bimbo is specifically looking for innovative solutions in the categories of products for kids, indulgent options, and artisanal offerings. (Contxto)

CAF to allocate USD$5 million to finance innovative startups

The Development Bank of Latin America and the Caribbean (CAF) has approved a $5 million investment in the NXTP Ventures Fund III, aimed at supporting innovative startups in the region.

Highlights. The investment will be channeled through the Investment and Business Development Fund (FIDE) to support small and medium enterprises (SMEs) in key areas such as cloud computing, fintech, and artificial intelligence. This investment aligns with CAF's objective of promoting investments in innovative sectors and reducing the access gap to capital for small businesses.

NXTP Ventures. NXTP Ventures, a prominent private equity fund in Latin America, has made over 200 investments since 2011 and aims to raise $110 million to foster innovation in the region. In addition to financial support, NXTP Ventures also focuses on promoting a positive environmental and social impact, including gender diversity. (Contxto)

LATAM startups to receive support from Cube Ventures-Innogen

Cube Ventures, a venture capital firm focused on supporting startups in Latin America, has partnered with Innogen, the first venture capital firm in El Salvador, to strengthen the business environment and facilitate access to investment.

The partnership. This collaboration aims to support the development of technology companies in the region and provide opportunities for startups seeking funding.

LATAMs VC ecosystem. Latin America has seen a rapid growth of startups driven by venture capital funds, and this partnership aims to strengthen the entrepreneurial ecosystem in the region.(Contxto)

Nestlé R&D Latam seeks food tech startups in the region

Nestlé's Research and Development Center for Latin America, in partnership with the UC Anacleto Angelini Innovation Center and Venture Capital Angel Ventures, has launched a call for proposals called "Challenge: Food Tech Startups".

The initiative. The aim of this initiative is to promote entrepreneurship and innovation in Latin America by seeking technological or digital solutions related to ingredients and raw materials.

Why is important for startups. The selected project will have the opportunity to join Nestlé's R&D accelerator and benefit from coaching and mentoring. Additionally, five other projects will be selected to join Incuba UC, an incubation program at the UC Innovation Center.(Contxto)

Finds

tools, websites, and accessories

Writer. Writer is an enterprise AI platform that helps companies accelerate growth and maximize productivity. It is built on secure, transparent LLMs that do not use user data for training and can be self-hosted. Writer offers capabilities such as creating great work effortlessly, generating insights and analysis, and enforcing brand and regulatory guidelines.

Corti. Corti is an AI co-pilot for virtual care that enhances and analyzes patient engagements. Trusted by industry leaders and medical professionals, Corti is trained on a vast amount of patient data and consultation audio. It aims to improve the experience for both healthcare professionals and patients by streamlining calls, reducing wait times, and empowering medical staff.

Pryon. Pryon is an AI platform that eliminates the distance between critical information and those who need it. It reads and understands unstructured content, providing users with instant answers from trusted sources. This helps eliminate wasted time searching for information and improves productivity.

Food for Thought

Why Tech Bros and Politicians Can’t Really Connect

The article discusses the conflict between batch culture and event loop culture in the tech world. Batch processing, where tasks are completed in discrete batches, was prevalent in the early days of computing. However, with the advent of event loops, technology became more interactive and responsive to user input.

The web, for example, shifted from static pages to dynamic experiences. The tech industry, with its focus on real-time reactions and user engagement, clashes with the slow and bureaucratic nature of government. (Wired)

3 Tips For VCs With Struggling Portfolio Companies

With VC investment remaining slow, startup failure rates are expected to be higher than usual. To mitigate risk, venture investors can either develop portfolio companies with better chances of success or abandon those that are performing poorly.

It is important for investors to engage with struggling startups that still have potential for survival. These startups can either be rescued and become profitable or sold to another company.

It is crucial for investors to have reasonable patience and be prepared for startup founders to pivot their strategies multiple times. Giving advice, rather than money, can help startups make smarter choices and operate more efficiently. (Crunchbase News)

Bootstrapping is cool once again

Bootstrapping, or self-funding a company, has traditionally been the first choice for many founders without access to investor networks. However, as investors become more selective, entrepreneurs are forced to explore alternative sources of financing.

This shift has reduced the stigma around bootstrapping and highlighted the value of being able to secure your own funding.

At TechCrunch Disrupt 2023, Erica Jain and Hussein Yahfoufi discussed the growing attention on bootstrapping and shared advice on how companies can approach it. Jain emphasizes the importance of thinking long-term and maintaining control over the capital journey of your business. (TechCrunch)

Worthy Recommendations

The Antisocial Network: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees, recommended by Brian Doubles, President and CEO, Synchrony.

The Antisocial Network: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees. “This book is an interesting dissection of the GameStop short squeeze that highlights the way in which social media is changing so many parts of our world. It sheds new light on how we share, analyze, and use information in a way that’s shifting investment power from Wall Street to Main Street.”, Brian says.

Jobs

Sr. HR Business Partner (HRBP) at Jeeves (Mexico, remote)

Online Growth Vice President at Frubana (Mexico City, not specified; São Paulo, not specified)

Corporate Accountant at Riot Games (Mexico City, not specified)

Head Of Agriculture Business Development – Brazil/Latam at Oxitec (Campinas, São Paulo, Brazil, remote)

Business Development Representative at Kajae (Latin America, remote)

Deals

These startups and companies received capital this week:

Colektia | Fintech | Debt. Venezuelan AI debt collection company, Colektia, has completed a financing round to acquire a debt portfolio worth USD $72 million. Colektia aims to help individuals resolve their debts and collaborate with financial institutions to improve efficiency in managing delinquent portfolios.

Infocheck | Fintech | Crowdfunding. Chilean startup Infocheck has raised USD $350,000 in a recent crowdfunding round. The fintech platform provides risk assessment reports to companies and SMEs, connecting to multiple sources to determine payment capacity and risk profiles. Notable investors include Érica Pavez and Pedro Orueta. The platform allows individuals to demonstrate their income, payment capacity, and commercial background through an online assessment report.

Kapital/Autofin Bank | Fintech | M&A. Mexican fintech company Kapital has completed its acquisition of Banco Autofin México (BAM), a retail and SME-focused bank, for USD $50 million. Kapital intends to invest in talent and technology to promote electronic payment methods and expand its reach across all sectors of the population

Mission Brasil | Tech | Seed. Brazilian on-demand services platform, Mission Brasil, has secured USD $1.3 million in funding led by Domo Invest and Headline Brasil. The funds will be used to introduce new products, invest in gamified missions, and expand its user database.

Iole Capital | VC | Seed. Brazilian investment firm Iole Capital raised USD $326,250 in a seed round. The investment firm is founded by experienced entrepreneurs and investors, aiming to acquire a quality company at a fair value and continue its growth. They bring a diverse profile of entrepreneurs and investors, with a long-term commitment, unique talent, and experience in the growth of small and medium-sized businesses.

Eunoia Capital | Private Equity | Seed. Mexican search fund Eunoia Capital raised USD $720,000 in a seed round. Eunoia Capital is an investment firm that offers private equity and growth capital, looking for Mexican companies with MXN $150 million in sales to invest in.

Daki | Delivery | Series D. Brazilian on-demand platform Daki has raised USD$50 million in a Series D funding round led by Convivialité Ventures, the investment arm of Pernod Ricard. The startup, which focuses on direct distribution and quick delivery, purchases products directly from suppliers to ensure authenticity and cost-effectiveness.

Flat.mx/Hipoteca Genial | Proptech | M&A. Mexican proptech company, Flat.mx, has acquired Hipoteca Genial, a platform that streamlines the mortgage process. The aim of the acquisition is to strengthen Flat.mx's mortgage credit advisory services. Flat.mx offers a range of services related to housing operations, including buying, financing, appraising, renovating, and legal services.

Verqor | AgTech | Venture. Mexican startup Verqor raised USD$3,9 million. The agtech startup is a platform that disrupts the agricultural sector with finances and technology. It gives farmers access to cashless credits that can be used for purchasing supplies and technology. Verqor uses an alternative data-driven credit scoring criteria, for reaching financial inclusion and technifying the fields.

Ruta 3 Automotores | Car Dealer | Debt Financing. Argentinian car dealer Ruta 3 Automotores raised ARS$300 million in debt financing. Ruta 3 Automotores is a company with more than 50 years of experience in the market, fully dedicated to the sale of 0 km, used cars and Renault spare parts in Argentina.