The investment opportunity for Latin America proptech sector

Mexico loves international ecommerce. Global early stage venture funding slows in November. Keyway is leading LatAm's innovation in the U.S. RE sector. How to allocate capital in R&D.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

Mexican Consumers Embrace International E-Commerce

Mexicans are showing increased interest in making online purchases, regardless of the product's origin. They are also looking to venture into new international markets, with 75% of Mexican business leaders planning to expand globally in the next 24 months.

Despite challenges, Mexican ecommerce consultancy Lievant is helping businesses reach the Chinese market, which presents significant opportunities. Mexican exports to the United States have increased by 117%, and other export destinations include Canada, Colombia, the UK, and Ireland.

Mexicans are willing to purchase digital services and physical goods online, with 78% open to online shopping. Diversifying payment methods is important to facilitate online shopping and build trust with customers.

Vía Mexico Business News

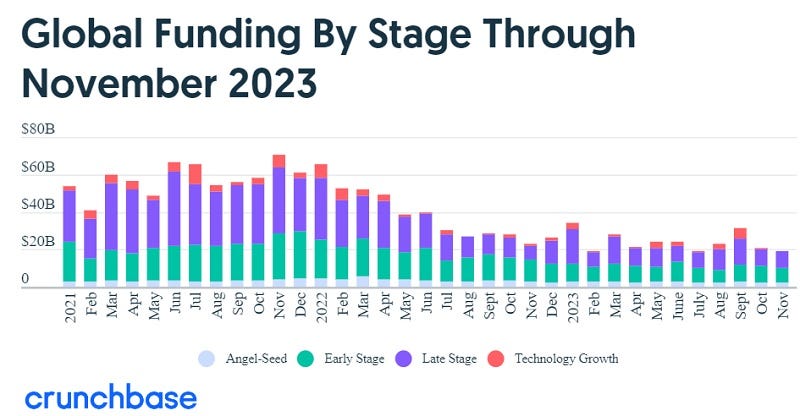

Global Venture Funding In November Slows At Early Stage

Global venture funding in November 2023 reached USD$19.2 billion, a slight decrease from the previous month. Compared to November 2022, funding was down by 16%.

Early-stage funding saw the biggest decline, dropping 34%, while late-stage funding increased by 7%. Healthcare and financial services companies received the most funding, with over $3 billion each. AI companies raised USD$2.4 billion, with the largest investments going to Aleph Alpha and Together AI.

Several notable events occurred, including the trial of Sam Bankman-Fried and the firing of Sam Altman at OpenAI. M&A activity also increased, with Rover and Talon Cyber Security being acquired for billions of dollars. Overall, venture funding to US companies accounted for nearly 50% of global funding.

Vía Crunchbase News

Proptech sector to be valued at USD$86.5 trillion by 2032

The real estate Proptech sector is expected to grow from USD$18.2 trillion in 2022 to USD$86.5 trillion by 2032. Latin America has a gap between startups and traditional companies in the Proptech real estate sector, providing investment opportunities. Colombia has a thriving IT market with 280 active startups.

Latin American startups received USD$8.7 trillion in venture capital investments in 2022, with Brazil receiving the most investment. The market in Latin America offers collaboration opportunities between large companies and startups. Many startups in the real estate sector need help accessing large companies to present their solutions.

The region has over 4,000 startups, with 41 reaching 'Unicorn' status. Proptech startups received 7% of annual expenditure, making it the fourth most attractive sector for investments. Colombia can identify trends in the sector to make effective investments and provide clarity for multinational companies.

Vía Contxto

Quick News

InDrive boosts LatAm startups with USD $100 million investment

InDrive, a global mobility and urban services platform, has launched its new Corporate Venture Capital division with a $100 million investment budget.

About the new fund. Led by Andries Smit, the division aims to revolutionize the startup landscape in emerging markets like Latin America. It will focus on investing in promising startups in the post-seed and pre-Series A stages that challenge injustices, improve lives, and show rapid organic growth.

Why it matters. The launch of this division reflects the growing importance of Latin America in the global startup ecosystem, with cities like Mexico City, Bogotá, and Curitiba showing potential. (Contxto)

Rockstart is allocating USD$6 million to accelerate 10 startups in Latin America

Startup accelerator Rockstart has selected ten companies from Colombia and Chile to join its acceleration program, with an investment of USD$6 million. Each of the selected companies will receive an initial investment of USD$100,000.

Highlights. Rockstart has achieved impressive results in previous years, with 82% of startups securing investments after the program.

Rockstart’s favorite sectors. The selected startups cover various sectors such as education, IT infrastructure, retail data analysis, mental well-being, and agriculture. (Contxto)

Jeeves 2.0 is the new stage of fintech to conquer Brazil

US fintech Jeeves, backed by major investors including Tencent and Andreessen Horowitz, is expanding into Brazil.

Brazil: Land of opportunities. Jeeves aims to accelerate its traction in Brazil by 2024 and plans to offer new features for its customer base of medium and large enterprises.

Business Model. Jeeves aims to provide cross-border payment solutions and corporate expense management, as well as the ability to view accounts from different countries in one place.

Jeeve’s markets. Jeeves is already present in 24 countries and its primary market in Latin America is Mexico. (Contxto)

Itaú Unibanco launches new cryptocurrency trading service

Brazilian bank Itaú Unibanco has launched a new cryptocurrency trading service, starting with Bitcoin and Ether. The bank plans to expand its offerings to other cryptocurrencies in the future, depending on regulatory developments.

Whyt it matters. The inclusion of cryptocurrency trading services by a major bank like Itaú Unibanco could signal a shift in the acceptance and integration of cryptocurrencies in the traditional banking sector.

Brazil is adopting crypto. This move comes at a time when two local operators recently exited the cryptocurrency market in Brazil. (Contxto)

Keyway: Leading Latin American Innovation in the U.S. Real Estate Sector

Keyway, a real estate technology company founded in 2020, aims to connect investors with real estate opportunities in the fragmented and opaque US market.

Keyway’s value proposition. The company utilizes advanced technologies such as AI, machine learning, and data science to provide predictive analysis and operational performance improvement.

Highlights. Keyway focuses on properties valued between USD$3 to USD$50 million, with a particular emphasis on Mexican investors who are major players in purchasing small and medium-scale commercial properties in the US. (Contxto)

Does Walmart affect financial inclusion in Chile?

Chilean fintech company Tenpo has accused Walmart of not allowing the use of prepaid cards in its stores and online platform, hindering financial inclusion in the country.

It’s not just Walmart. Walmart and Falabella.com are the only major retailers in Chile that do not accept prepaid cards.

Tenpo’s argument Tenpo argues that this refusal harms consumers and the payment industry, leading to the closure of some players. The company is urging others to defend the free choice of payment methods.

Walmart’s point of view. Walmart Chile opposes high commissions for debit cards and claims that cash transactions are more economical for the chain. (Contxto)

Endeavor celebrates three years of partnership with Mastercard

Endeavor and Mastercard celebrate their three-year alliance, which has been instrumental in consolidating the entrepreneurial ecosystem.

Highlights. The alliance has provided networking, mentoring, and leadership experiences to over 150 entrepreneurs, totaling over 450 hours of knowledge and valuable connections.

About the partnership. The collaboration aims to advance the future of industries by connecting entrepreneurs, mentors, investments, and strategic connections. (Contxto)

Fōcaris & Taanaj wins best entrepreneur award from Tec de MTY

Gerardo Calderón and Laura Aldana, students from Tec de Monterrey State of Mexico campus, have been recognized as Entrepreneurs of the Year for their project Fōcaris & Taanaj.

Value proposition. The project aims to address the housing problem in Mexico by offering a sustainable and affordable solution.

About the project. Gerardo designed "hexablocks," alternative building units made from a biopolymer that captures rainwater, while Laura created a sustainable paint made from organic waste. (Contxto)

Mediquo projects expansion and doubling sales in LatAm by 2024

Spanish telemedicine startup Mediquo is poised for growth in the Latin American market, with plans to double its sales and surpass USD$3 million in revenue by 2024.

Value proposition. The company offers a platform that allows healthcare professionals to provide medical care to patients through chat, calls, and video calls.

Highlights. Mediquo has already achieved sales of over USD$200,000 in Ecuador and aims to reach USD$870,000 in revenue in Brazil this year. The startup has attracted over one million registered users and manages 1.5 million consultations annually. It recently closed a funding round of $1.4 million, which has helped strengthen its presence in Spain and expand throughout Latin America. (Contxto)

SIMBig to hold its tenth edition at IPN in Mexico City

The National Polytechnic Institute (IPN) in Mexico City will host SIMBig 2023, the International Conference on Information Management and Big Data.

About SIMBig. The conference aims to showcase new methods of Artificial Intelligence and related fields for analyzing and managing large volumes of data. It brings together experts in areas such as AI, machine learning, health informatics, and software engineering.

Some numbers The event has seen over 2,000 participants in previous editions, with renowned speakers and research articles published. This year, SIMBig plans to establish itself as one of the most significant events in Latin America and the world. (Contxto)

Mytos raises USD$19 million for its cellular production system

Mytos, a company specializing in automating cell manufacturing, has raised USD$19 million in a Series A funding round.

About the funding. Led by Buckley Ventures, with participation from IQ Capital and Wing VC, the investment will support the production and distribution of Mytos' automated cellular production system to biotech and pharmaceutical companies.

Value proposition. The system automates the complex process of human cell production, which has been a major obstacle in drug development. By streamlining the process, Mytos frees up scientists' time, reduces the risk of errors and contamination, and improves the quality of cells. (Contxto)

Finds

tools, websites, and accessories

Deepgram. From startups to NASA, Deepgram APIs are used to transcribe and understand millions of audio minutes each day. Fast, accurate, scalable, and cost-effective. Everything developers need to build with confidence and ship faster.

LogoPicture AI. LogoPicture AI is a platform that allows users to create optical illusion art using their logos. Users can upload their logos, choose from a variety of predefined styles, and generate 50+ pictures with their logos.

Lebesgue. Lebesgue helps businesses analyze data from Google, Facebook, and Instagram Ads to identify and solve critical mistakes. It also allows businesses to benchmark their ads against industry standards and provides market research and competitive analysis.

Food for Thought

Allocating capital for research and development (R&D) is a crucial task for growth-stage CEOs. However, many CEOs struggle to justify and explain their R&D budgets. Unlike other spending categories, measuring the return on investment (ROI) for R&D is more complex and variable. To effectively allocate R&D capital, CEOs should use benchmarks as a starting point, map their spending to their product roadmap, and focus on performance management of their product and engineering teams.

The 70-20-10 rule is a commonly used framework for R&D spend, but it may not apply in all cases. CEOs should also consider offensive and defensive bets with short- or long-term horizons.

Regular assessment of R&D priorities and performance is crucial for success. Ultimately, applying a rigorous framework to assess the ROI of R&D is essential for building an enduring company. (a16z)Lessons on building a viral consumer app: The story of Saturn

Saturn, a viral consumer app targeted at Gen Z, has achieved great success by embracing single-player mode as a starting point and focusing on building a product that feels personalized for users. The founders, Dylan Diamond and Max Baron, have learned valuable lessons in their journey, including the importance of retention and the need for a strong single-player use case before introducing social features.

They also emphasize the value of building a product that solves a problem they have experienced themselves. By taking a long-term approach and constantly improving retention, Saturn has grown to millions of users and thousands of schools.

The founders highlight the significance of creating a personal and tailored experience for users, as well as the benefits of launching white-labeled apps for individual schools. (Lenny’s Newsletter)Marc Randolph, former Netflix CEO discusses the importance of pitching your idea as an entrepreneur and suggests using the "Starbucks Test" to gain valuable insights.

Marc recommends approaching people at Starbucks, offering to buy their coffee in exchange for listening to a two-minute pitch and discussing their thoughts. By asking specific questions, entrepreneurs can gauge the clarity of their messaging and understand the pain points and needs of potential customers.

If Starbucks isn't suitable, the author suggests finding a setting where target customers congregate. The text emphasizes the value of iterating and refining pitches based on real-world feedback, comparing it to the process of comedians and infomercial creators. The key takeaway is that entrepreneurs should actively seek validation and practice their pitches to improve their chances of success. (Marc’s Substack)

Worthy Recommendations

Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger, recommended by Shane Parrish, founder of Syrus Partners and Farnam Street.

Poor Charlie’s Almanack. “Poor Charlie’s Almanack is a timeless classic that will change how you approach life. There is a billion-dollar education inside this book.”, Shane says.

Jobs

Sr Business Intelligence at Globant (Mexico City, Mexico; Hybrid)

Operations Program Manager at Scale AI (Mexico City, Mexico; Remote)

Sr. Product Manager Marketplace, Latam 3P at Amazon (Mexico City, Mexico; Not specified)

Growth Lead, LatAm at Binance (São Paulo, São Paulo, Brazil; Remote)

Account Growth Manager at Rappi (Bogota, D.C., Capital District, Colombia; Hybrid)

Deals

These startups and companies received capital this week:

Impacta VC | VC | New fund. Chilean venture capital firm, Impacta VC, has announced the completion of its first investment fund, totaling USD$7 million. The fund focuses on early-stage startups in Latin America and aims to help them secure Series A funding. The portfolio includes companies such as Airbag, Betterfly, and Wheel the World.

Konsi | Fintech | Seed. Brazilian startup Konsi has raised R$3 million in a seed funding round led by Valutia. Konsi aims to reduce interest rates on payroll loans and provide comparative analysis. The funds will be used to expand its services and strengthen its presence in the market, to serve all federal, state, and municipal employees in Brazilian capitals by 2025.

Brinta | SaaS | Seed. Uruguayan startup Brinta has raised USD$5 million in a seed round led by venture capital firm Kaszek. Brinta specializes in tax compliance and aims to automate tax processes in the complex Latin American market. The company converts accounting data into real-time tax filings and electronic invoice generation.

Nuvini/Semantix | SaaS | Strategic Partnership. Brazilian companies Nuvini Group Limited and Semantix, Inc. have announced a strategic partnership to leverage the power of AI. The partnership aims to enhance the operations of Nuvini's portfolio of companies by implementing AI-driven solutions to improve efficiency, productivity, and decision-making processes.

Tenaris/Mattr | Oil & Gas Equipment & Services | M&A. Tenaris, a global supplier of steel tubes for the energy industry, has completed the acquisition of Mattr's pipe coating business unit. The deal, valued at $182.6 million, includes nine plants across various countries, R&D facilities, and a wide IP/product portfolio. This acquisition will expand Tenaris' capabilities in the pipe coating sector.

Sonoco/Inapel Embalagens | Packaging & Containers | M&A. Sonoco, a global packaging leader, has announced the expansion of its flexible packaging service operations with the acquisition of Inapel Embalagens Ltda. in Brazil. Inapel is a leading manufacturer of flexible packaging with over 50 years of experience. The acquisition aims to grow and expand Sonoco's portfolio of sustainable packaging solutions.

Visa/Pismo | Financial Services | M&A. Brazil's antitrust body, Cade, has approved Visa's acquisition of fintech Pismo for USD$1 billion. The purchase will strengthen Visa's presence in Latin America and expand Pismo's capabilities. This acquisition will allow Visa to offer banking capabilities and processing services and provide support for new payment methods.

Megatelecom/InterNexa Brasil | Teleco | M&A. Sao Paulo-based company Megatelecom has agreed to acquire InterNexa Brasil, a B2B operator. The deal will give Megatelecom access to InterNexa's backbone network, connecting key locations in southern Brazil. The transaction's value has not been disclosed and still requires approval from regulatory authorities.

Nuvemshop/Perfit | Ecommerce | M&A. Brazilian ecommerce platform Nuvemshop has announced its acquisition of Perfit, a marketing automation provider. The move aims to enhance sales and marketing campaigns for brands using Nuvemshop's platform. Perfit's technology utilizes artificial intelligence to optimize marketing strategies, sending tailored messages to contacts at the ideal time.

Circle/Nubank | Fintech | Strategic alliance. Circle, the company behind the stablecoin USDC, has formed a strategic alliance with Nubank, the largest neobank in Brazil. The partnership aims to promote the adoption of USDC in Brazil, a country that has seen significant growth in cryptocurrencies, particularly stablecoins. The collaboration will allow Brazilian users to access and trade USDC through the Nubank platform.

The Latin American proptech sector offers immense investment opportunities, with rapid growth and innovation leading the way. Keyway's advancements and collaborations, coupled with significant venture funding, underscore the region's potential. This vibrant startup ecosystem, driven by promising proptech solutions, positions Latin America as a key player in the global real estate technology landscape. Exciting times ahead!