The challenges that Starlink is facing in Latin America

TikTok vs. Amazon. Insurance against drug cartels. Best ways to lose money as an angel investor. Red flags when investing in startups.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

Starlink in Latin America: A game changer or a technological mirage?

SpaceX's Starlink project aims to provide global internet coverage by launching thousands of small satellites into low Earth orbit. The company had ambitious projections but has fallen short of its goals, with revenues of $1.4 billion in 2022 and 1.5 million subscribers.

Starlink has expanded into Latin America, where it hopes to reduce the digital divide and provide high-speed internet access. However, it faces challenges such as space pollution, regulatory obstacles, and high costs for users. The next few years will determine if Starlink can fulfill its potential in the region.

In the case of Mexico, Starlink has adapted its prices to fit the Mexican market, requiring an initial payment of approximately USD $486 for the installation kit and antenna, followed by a monthly fee of around USD $64. Given that nearly 44 million people in Mexico lack internet access, the promise of comprehensive coverage throughout the country is a significant advantage.

Vía Contxto

Could TikTok Kill Amazon?

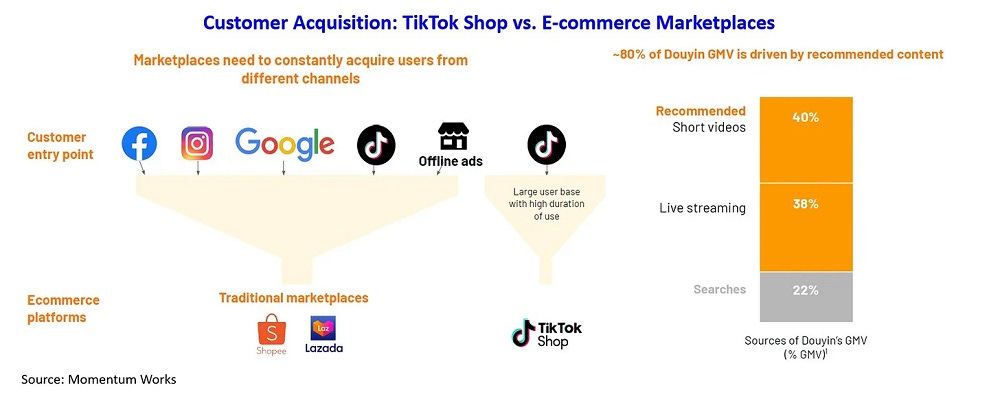

The article discusses TikTok's launch of TikTok Shop in the US, which allows users to buy products directly in the app. It compares TikTok's potential to compete with Amazon based on its success in the Chinese market.

The article also mentions TikTok's plans to offer discounts, free commissions, and advertising opportunities for merchants. Additionally, it highlights TikTok's creator marketplace, which connects influencers with brands.

Vía The Split

Quick News

Luis Enriquez, Founder of Cultura Colectiva, Joins Bridge Latam as New Partner

Bridge Latam, a Venture Capital fund in Latin America, has added Luis Enriquez as a Partner, bringing his strategic vision and experience to boost the success of emerging regional companies.

Luis track record. Enriquez, who founded and led Cultura Colectiva for 12 years, brings his experience and strategic vision to the fund's mission. With his arrival, Bridge Latam aims to boost the success of emerging regional companies.

Bridge Latam. The fund has invested in 18 startups in various sectors and is backed by significant investors. (Contxto)

Habi Receives Notoriety Status from Colombia’s Superintendency of Industry and Commerce

Habi, a Colombian proptech company, has been granted notoriety status by Colombia's Superintendency of Industry and Commerce, solidifying its position as one of the country's most recognized brands in the real estate sector.

Value proposition. Founded in 2019, Habi uses data-driven technology to revolutionize the real estate market. Latin America faces a housing deficit, and Habi aims to provide innovative solutions.

Leading Latam tech real estate. This recognition confirms Habi's position as one of the most influential technology companies in Latin American real estate.(Contxto)

CAF Launches Call to Fund Fintech Focused on Migrants

The Financial Inclusion Laboratory (LIF 2023) is focusing on improving financial inclusion for migrant populations and SMEs owned by migrants in Latin America and the Caribbean.

The program. Startups from CAF member countries can participate and compete in three categories: enhancing education and financial capabilities of migrants, designing financial products and services for migrants, and impacting the entrepreneurial abilities and productivity of migrant SMEs.

Time is running out. Hurry up! The call is open from August 28 to October 13, 2023, with project review and selection in November. (Contxto)

BBVA Spark to support technology startups in Argentina

BBVA Spark, a project by BBVA bank, has expanded to Argentina to support high-growth businesses in the country.

The initiative. The initiative provides startups with financial services, specialized support, and access to the technology ecosystem.

BBVA Spark’s mission. BBVA Spark offers flexible financing options, comprehensive banking offerings, and connections to investors and accelerators. (Context)

Demand for cartel insurance increases in Latin America

Insurance group Chaucer has seen a surge in demand for coverage against cartel violence in Latin America.

The insurance. The product, an extension of Strike, Riots, and Civil Commotion insurances, covers material damages caused by cartels in Mexico, Guatemala, Honduras, and El Salvador. The insurance provides companies with greater security in case they fall victim to cartel activity.

The concern about the cartels. Cartel activity has become a major concern for businesses in the region, particularly in tourist destinations like Cancun. (Contxto)

Fondo Córdoba Ciudad Inteligente selects startups for investment

The Fondo Córdoba Ciudad Inteligente, the first govtech initiative in Latin America, has selected six startups to receive investment.

The startups. The startups, including Creativos Digitales, KIGUI, AGROHUB, MOTHUS, APELIE ROBOTICS, and DATASKETCH, will receive $700,000 to implement innovative solutions in Córdoba Capital in areas such as education, health, social development, and modernization.

The first of his class in Latam. This initiative is the first in Latin America where a government partners with startups through venture capital to address public, social, and environmental issues. (Contxto)

NTT DATA and Camiseteados support female talent in technology

NTT DATA and Fundación Camiseteados have launched the "Camiseteadas for Technology" initiative for the second year in a row.

Highlights. The goal is to recognize women, youth, and adolescents who are making a positive impact in technology.

The initiative. Nominations can be made until September 28, 2023, and the winners will be highlighted and celebrated by the community. The initiative aims to promote and empower women in the fields of Science, Technology, Engineering, and Mathematics (STEM). (Contxto)

Evsy launches new collaboration features on its platform

Chilean startup Evsy has introduced a new feature on its app that allows users to rate, add, and comment on electric car charging stations.

Value proposition. The app, which maps charging stations and enables users to pay for recharging through the platform, aims to provide up-to-date information on the status and condition of stations. Evsy, considered the first social network for electric car users, also installs charging stations in residential buildings.

The opportunity for electric cars. The startup launched in Chile and has expanded to other Latin American countries. With the growing popularity of electric cars worldwide, startups and apps focused on improving the user experience in this sector are on the rise. (Contxto)

Credicorp to turn fintech Tenpo into neobank

Credicorp, a Peruvian financial company, plans to transform Tenpo, a Chilean fintech, into a fully digital bank by 2025.

Why it matters. The CEO, Gianfranco Ferrari, stated that their aim is to have a 100% digital retail bank in the next two years. Credicorp sees the digital bank as a transformative opportunity in the Chilean market. (Contxto)

IDB Lab and EIT Climate-KIC to create climate startups program

BID Lab and EIT Climate-KIC have partnered to launch a startup acceleration program focused on climate solutions in Latin America and the Caribbean.

The program. The program aims to support startups working on reducing carbon emissions. They are seeking organizations with experience in entrepreneurship and startup acceleration programs in the region to participate.

Save the date. Startups have until September 30 to register.(Contxto)

Finds

tools, websites, and accessories

DimeADozen.ai. This AI helps you to instantly validate business ideas, save valuable time, decide to pivot, and invest wisely.

Launchmates.ai. This AI helps businesses to hit revenue earlier. Leverage the power of AI to effectively hit milestones, seize growth opportunities, and outperform the competition.

Kunzapp. Save up to 20% on your SaaS subscriptions with Kunzapp. They make managing software in a company easy, saving CFOs/CTOs time and generating up to 20% savings. They help you stop paying for unused SaaS licenses and track all the tools in your organization.

Food for Thought

Red Flags that you need to look for when investing in startups

Investing in startups can be risky, so it's important for investors to watch out for red flags that indicate potential problems. These red flags can be categorized into five areas: equity frame, intellectual property, market, finance, and human capital.

It's important for founders to be transparent and strategic in their approach, as well as consider the advice and guidance of investors. (LinkedIn)

Key metrics for pre-seed and seed fundraising in challenging markets

Startups seeking early-stage funding in a down market need to adapt their tactics to capture investor attention. While fundraising has slowed across all stages of venture-backed startups, deals are still being made.

Founders can raise capital by strategically approaching their fundraising efforts and focusing on the right metrics. Key metrics to consider include burn rate and runway, which illustrate the efficiency of the business and its capital needs.

Calculating the total addressable market (TAM) is also essential to demonstrate market opportunity. Investors want to see healthy user acquisition numbers and a favorable LTV/CAC ratio. Additionally, presenting a financial model that shows flexibility and making realistic projections can help secure funding. (Mercury)

The 7 best ways to lose money as an angel investor

The article highlights that angel investors should have a deep understanding of the markets they invest in and should prioritize the interests of the people whose money they are investing.

It also acknowledges that angel investors may have various motivations for investing. Investing at the earliest stages of a company is highly risky, and there is no guarantee of returns.

The article concludes by suggesting that by avoiding certain pitfalls, angel investors can increase their chances of success. (TechCrunch)

Worthy Recommendations

Human Work in the Age of Smart Machines, recommended by Alisa Miller, Cofounder and CEO, Pluralytics

Human Work In the Age of Smart Machines. “This book came out only a short time before the generative AI wave but is even more relevant today when we talk about human talent in an age of smart machines.”, Alisa says.

Jobs

Sr. HR Business Partner (HRBP) at Jeeves (Mexico, remote)

Online Growth Vice President at Frubana (Mexico City, not specified; São Paulo, not specified)

Business Development - Senior Vice President at Infomineo (Mexico City, not specified)

CEO at Listopro (Mexico City, hybrid)

Lead Software Engineer at Nubank (Mexico City, hybrid)

Deals

These startups and companies received capital this week:

Mottu | Car sharing | Series C. Sau Paulo-based startup Mottu has raised USD$50 million in a series C round to expand its last-mile logistics operations in Brazil and Mexico, as well as enter the mobility market. The company provides last-mile delivery services to restaurants, retailers, and e-commerce businesses in Brazil and Mexico.

N5 | Fintech | Series A. Argentinian fintech company N5 has raised an undisclosed amount in a Series A round led by Illuminate Capital. Other investors include Exor Ventures, LTS Investments, and Arpex Capital. N5, which provides software solutions for the financial services industry, is available in 15 countries and plans to expand its team by 60% by the end of 2023.

Fretadão | Ride sharing | Venture Round. Brazilian corporate transportation startup Fretadão has also announced a USD$10 million investment led by EXT Capital. The funds will be used to acquire buses, microbuses, and vans for lease by affiliated operators. Fretadão aims to serve new clients without displacing its partners and has seen a significant increase in daily user count.

Minerva Foods | Food Processing | Post-IPO Debt. Brazilian fresh beef exporter Minerva Foods has raised USD$100 million in debt. Minerva Foods is a leader in beef export in South America and also operates in the processed segment, selling its products to more than 100 countries.

Casas Bahia | Retail | Post-IPO Equity. Brazilian retailer Casas Bahia has raised R$622 million reais (USD $126.53 million) in a share offering. The company had initially expected to raise R$981 million reais. The company plans to use half of the proceeds for a capital increase and the other half as a reserve.

Ecopetrol | Energy | Post-IPO Debt. Banco Latinoamericano de Comercio Exterior (Bladex) has successfully closed a USD$1 billion Term Loan Facility for Colombia’s largest energy company Ecopetrol S.A. and one of the main integrated energy companies in the Americas.

Eletrobras | Energy | Post-IPO Debt. Brazilian state-owned power company Eletrobras has raised R$7 billion (USD$1.3 billion) in debt issuance, marking the largest fixed-income market issuance in the country. The issuance was coordinated by BTG Pactual, Bradesco BBI, UBS BB, and Santander.

BlindCreator | SaaS | Pre-Seed. Blind Creator, a Mexican platform for influencers and content creators, has raised MXN $10 million in a pre-seed funding round. The platform offers a comprehensive CRM and aims to professionalize influencer marketing in Mexico, which has a large market of over 670,000 influencers.

CBRSPC | AI | Seed. Brazilian healthcare startup CBRSPC just raised R$500,000 in a seed round. The startup is dedicated to delivering comprehensive medical services and innovative solutions. With a commitment to excellence, CBRSPC strives to enhance the well-being of individuals and communities through a range of healthcare offerings.

Nagro | Agro Fintech | Venture. Agro fintech Nagro has raised USD$49 million in equity and debt to provide credit solutions for rural producers. The funding round saw participation from Kinea Ventures and Revolution, a fund managed by Oasis Ventures.