Latin America's banking shift and startup investment slump

An exclusive with investment fund Bridge. The banking transformation in Latam. Investments in Latam's startup ecosystem are declining. Argentina: The paradise for Fintech investments.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

Bridge: A Fund by Founders for Founders Driving LatAm’s Technology Future

Bridge, an investment fund based in Mexico, was established between 2020 and 2021 by a collaboration of 10 entrepreneurs. Initially focused on angel investments, they scaled their operations in mid-2021, raising over USD$15 million for early-stage startups across Latin America.

The fund has already made 18 diverse investments in countries including Mexico, Colombia, Chile, Argentina, and Brazil. Bridge's investment thesis emphasizes startups with strong technological potential and scalability, with an average investment ticket size ranging from USD$200,000 to USD$500,000.

A unique aspect of Bridge is its founder-focused approach, prioritizing the individuals behind startups. The fund also leverages data-driven strategies, using machine learning and AI to predict startup success. Looking forward, Bridge aims to expand its portfolio and is considering the creation of a new fund.

Vía Contxto

Banking transformation in Latin America: the convergence of technology and customer experience

The financial sector in Latin America is undergoing a significant transformation, with technology reshaping the relationship between banking and other areas. As banks become more environmentally and socially conscious, they are prioritizing customer demands and moving towards decentralization.

Fintechs, like Nubank, have set high standards for customer experience, pushing traditional banks to innovate. Latin America has witnessed rapid growth in the fintech sector, especially in countries like Brazil and Mexico.

Traditional banks are now focusing on providing more humanized experiences, emphasizing sustainability, ethics, and personalization. They are leveraging data analysis and artificial intelligence to offer tailored solutions. The trend also includes merging digital and physical experiences, with interactive kiosks and pop-up banks.

Vía Contxto

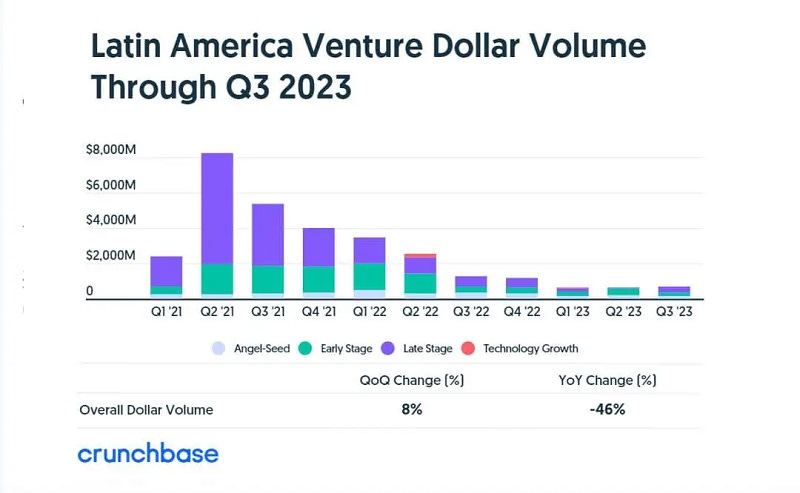

Decline in initial investments shakes the startup ecosystem in Latin America

Investments in Latin American startups have seen significant fluctuations in 2023. Data from Crunchbase reveals that while the third quarter of 2023 experienced an 8% funding increase from the previous quarter, it marked a 46% decrease compared to the same period in 2022. The year 2021 was a high point for the region, with startups receiving a record USD$13 billion in investments.

However, the first three quarters of 2023 only saw about US $2 billion in investments. The third quarter of 2023 was notable for late-stage investments, with companies like Loft, Mottu, and Gringo securing significant funding. In contrast, early and seed-stage investments declined sharply.

Established companies, such as Loft, Neon, and Rappi, have made adjustments, including layoffs, in response to the changing financial landscape. Despite these challenges, the recent uptick in late-stage investments suggests continued investor interest in promising companies, albeit at potentially lower valuations.

Vía Contxto

Quick News

Nu makes transaction under the sea and imposes Guinness Record

Brazilian bank Nu Bank has achieved a Guinness World Record by conducting the first submarine transaction at a depth of 20 meters in Mexico. A diver descended underwater with a cellphone connected via an ethernet cable to ensure internet connectivity.

Highlights. The purpose of this feat is to demonstrate that users of digital financial services can have control over how they interact with their money.

Nubank’s plans. Nu Bank, considered the leading digital bank in Latin America, aims to expand in Mexico and end "financial prehistory" with their NU-era campaign. They plan to launch a campaign featuring actress and producer Karla Souza to reach 50 million people. (Contxto)

The Chilean startup Reqlut is seeking companies willing to offer remote jobs in LatAm

Chilean startup Reqlut is actively seeking companies to participate in the Professional Development Summit 2023.

The summit. The summit aims to connect students and recent graduates in Latin America with job opportunities, particularly remote positions. In addition to a job fair, the event will feature talks and meetings to foster professional growth.

Register now! Companies interested in participating can register at https://summitprofesional.com. (Contxto)

LATAM startups selected for CIC International Soft Landing

The Cambridge Innovation Center (CIC) and ProChile have announced the eight health-tech startups selected for the CIC International Soft Landing program.

About the program. The program aims to support these startups in expanding their businesses internationally, particularly in the United States. The startups will undergo a six-week online training that covers various topics related to the healthcare technology sector and the differences between the Chilean and American markets. They will also receive mentorship and regulatory compliance insights.

What kind of startups they’re looking for? The selected startups include companies involved in clinical simulators, medical inventory management, custom craniofacial implants, innovative sports products, hospital management platforms, clinical management software, clean area construction systems, and first aid product development. (Contxto)

The Mexican fintech Baubap plans to reach 6 million users and launch savings products in 2025

Mexican financial company Baubap has unveiled its growth vision for the short and medium term. Their goal is to quadruple their user base by the end of 2023 and expand their services to 6 million users, granting loans totaling MXN $12,000 million.

A challenging startup investments ecosystem. Despite a significant decline in global startup investments, Kaszek has managed to invest in seven companies, including Colombian fintech Cobre.

Baubap’s highlights. Baubap plans to launch savings products by 2025 and will focus on enhancing its digital operations. The company has a strong track record with a loan recovery rate of over 90% and a delinquency rate below 10%. Baubap aims to provide financial solutions to those who have previously had limited access to formal finance, promoting financial inclusion. (Contexto)

The Superintendency of Industry and Commerce sets new rules for Colombian fintechs

Colombia's Superintendency of Industry and Commerce (SIC) has taken regulatory actions against fintech companies following consumer complaints.

The complaints. The complaints highlighted issues such as excessive interest rates, undisclosed fees, and unauthorized disclosure of credit information.

Guidelines. To protect consumer rights, the SIC has issued guidelines, including providing detailed information to clients, charging late interest only on overdue payments, and eliminating abusive clauses from contracts. Non-compliance could result in fines, temporary closure, or even permanent closure of the company. (Contxto)

Vitaldoc and Keiron form alliance to combat medical shortage and improve care in Chile

Chilean startup Vitaldoc has introduced a hybrid medical care system that combines in-person nursing technicians with virtual doctor assistance.

Value proposition. This innovative approach aims to address the shortage of doctors in Chile and reduce long wait times for medical attention.

Vitaldoc’s/Keiron highlights. Vitaldoc has partnered with healthtech company Keirón to streamline the care process and improve efficiency. Patients can schedule appointments, make payments, and provide their medical history through a self-payment kiosk. Using Tytocare technology, Vitaldoc has already served over 200 people and plans to expand to 150 locations in the next two years. (Contxto)

Startup Dynamics launches its second edition to boost business efficiency of startups in LatAm

Startup Dynamics, an initiative by Rebelius, is seeking startups in Latin America to participate in a free program aimed at improving their business efficiency.

The program. The program offers startups the opportunity to gain insights into their operations, internal management indicators, and team engagement. By reflecting on their strengths and improvement areas, startups can benchmark themselves against other companies in the region.

Save the date. The deadline for participation is November 3rd. (Contxto)

Chilean startup Zerviz begins operations in the United States

Chilean startup Zerviz has expanded its operations to San Francisco to cater to the North American market.

Business model. The company, which collaborates with Amazon Web Services, specializes in customer experience solutions and services. With a presence in 16 countries, Zerviz aims to provide the same level of service to companies in the US as it does to its Latin American clients.

Zerviz’s plans. Zerviz aims to become a leader in the customer experience sector by understanding the challenges and needs of companies before determining the appropriate technology to use. (Contxto)

Nax Solutions expands its innovative agricultural technology to Mexico, Colombia, and Brazil

Spanish startup Nax Solutions, known for its agricultural technology solutions, is expanding globally.

Partnerships in Latam. Nax Solutions has partnered with Grupo Azucarero del Trópico in Mexico to implement innovative agrarian models. In Colombia, they have collaborated with Incauca to train sugarcane suppliers in artificial intelligence and optimize crop management. Nax Solutions has also signed an agreement with Satlantis in Brazil to develop satellite precision agriculture solutions.

The agtech sector in Latam. The agtech sector in Latin America is growing, providing fertile ground for innovation. (Contxto)

Banco Santander, in collaboration with the Oxentia Foundation, has initiated the "Santander X Global Challenge | Transforming the Digital Economy."

Objective. The challenge targets emerging and growing companies to pinpoint solutions that utilize new technologies to reshape the economy.

Participation. Companies from eleven countries, spanning Latin America to Europe, are eligible to submit their ideas. Countries include Argentina, Brazil, Chile, Mexico, and Spain.

Save the date. Proposals can be submitted until December 12 on the Santander X platform. (Contxto)

Cube Ventures and Innogen partner to boost the startup ecosystem in Latin America

Cube Ventures and Innogen have formed a strategic partnership to bolster the startup ecosystem in Latin America.

Highlights. This collaboration aims to enhance the entrepreneurial environment, expand both companies' geographical reach, and unveil new investment opportunities.

Why it’s important. The partnership seeks to bridge opportunities for startups looking for financing and promote a culture of knowledge exchange. (Contxto)

Miranda Partners and AMG Block Ventures launch venture capital fund for Mexican startups

Miranda Partners and AMG Block Ventures have launched "Miranda Ventures," a new venture capital fund in Mexico dedicated to supporting emerging startups.

Value proposition. Instead of traditional fees, startups will exchange shares for services, including investor relations and digital marketing. The fund aims to foster the growth of tech startups in Mexico, providing them with expertise in communication, marketing, and research.

The partnership. The collaboration will prioritize startups that have received or are in the process of securing investments from major regional venture capital funds. (Contxto)

Tul exceeds USD$200 million in investment rounds

Founded in 2020, Tul is a startup aimed at supplying hardware stores in Colombia with essential products.

Highlights. Despite the initial challenges of competing with established brands, Tul's growth was significantly boosted after its participation in the Suite World event by Oracle NetSuite. Recognizing the limitations of Excel for data management, Tul transitioned to Oracle NetSuite's ERP system in mid-2020, which greatly enhanced its data management capabilities.

VC’s darling. This strategic move led to an expansion of its customer base from 50 to over 8,000. As of June 2023, Tul has successfully raised over USD$200 million in investment rounds. (Contxto)

Investments in Fintech companies grow 183% in Argentina

Investments through Fintech companies in Argentina have seen a significant surge. According to the Central Bank of the Argentine Republic (BCRA), balances invested via these platforms grew by 183% from January to July 2023.

Highlights. These Fintech platforms offer investment accounts, allowing users to earn interest while maintaining easy access to their funds. By July, investments in virtual wallets reached ARS$438.7 billion, a substantial increase from ARS$154.8 billion in January.

Fintech’s to Argentina’s rescue. Additionally, the number of investment accounts opened has risen dramatically, from 630,000 in July 2019 to 12.8 million in July 2023. This growth indicates that Fintechs have provided a popular saving alternative for many Argentinians. (Contxto)

Brazil dominates the cryptocurrency market in Latin America

Brazil is leading the cryptocurrency market in Latin America, ranking ninth globally in the adoption of digital assets, according to a report by Chainalysis.

Findings. Between July 2022 and June 2023, Brazil received cryptocurrency investments totaling USD$85.3 billion, closely followed by Argentina with USD$85.4 billion.

Highlights. The analysis indicates that Brazilians are more inclined towards long-term investment assets, while Argentinians often opt for USDT, which is pegged to the US dollar. Overall, Latin America's crypto market accounts for 7.3% of global crypto activity during the mentioned period. (Contxto)

Finds

tools, websites, and accessories

Photo AI. Photo AI is an AI-powered platform that allows users to upload selfies and create realistic AI characters. Users can then generate AI photos of themselves in various settings, outfits, and expressions.

guidde. "Magic Capture" allows users to easily create video documentation of complex processes. Users can capture their workflow using a browser extension and the tool will generate a step-by-step description of the process. The tool also offers a variety of voices and languages for the voiceover narration. Users can design the visuals without needing professional design skills. The created video documentation can be easily shared through links or embedded in organizations.

LogicBalls. LogicBalls AI apps are designed to help businesses and marketers create persuasive and engaging content. They offer a variety of tools, including a course description generator, a paraphrasing tool, an advertisement script generator, and a Facebook hashtag generator, among others. LogicBalls aims to improve productivity, generate leads, and save costs by providing efficient content creation.

Food for Thought

Written by Marc Andreessen, this essay argues for a positive and optimistic view of technology and its impact on society. It states that technology is the main driver of growth and progress, leading to improved living standards and well-being.

The author also emphasizes the importance of free markets in organizing a technological economy, highlighting their efficiency, ability to lift people out of poverty, and capacity for innovation.

It argues that markets are a way to generate societal wealth and align capitalist profits with social welfare. (az16)Generalist Or Specialist? Deciding What Type Of Investor Is Right For Your Startup

When seeking investment for your startup, it's important to choose the right investment partner. There are two types of venture capital firms: generalist and specialist.

Generalist firms offer a broad network and diverse market exposure, while specialist firms provide targeted support and industry-specific insights. It's important to consider your goals and the type of support you need when selecting a VC partner.

Ultimately, finding an investor who understands your vision and industry is crucial for success. (Crunchbase News)What Loom & Klaviyo Indicate about Exit Valuations

Written by Tomasz Tunguz, VC investor and founder of Theory Ventures, the article discusses two recent exits in the startup industry - Klaviyo's IPO and Atlassian's acquisition of Loom. It compares the last private round valuation to the exit value and notes that both companies were sold at a discount. However, when the valuation environment is normalized, taking into account the change in market conditions, Loom's relative multiple has increased while Klaviyo's has decreased.

Tomasz suggests that startups may be more valuable today compared to two years ago, but this could also be statistical noise. The author struggles to explain the decrease in Klaviyo's multiples, speculating that it may be due to a higher interest rate environment and geopolitical tensions affecting valuations.

The increase in Loom's multiple suggests that Atlassian paid a premium for the company, possibly due to its rapid growth or a competitive bidding process. Overall, the article suggests that the acquisition market is moving in sync with the public valuation environment. (Tomasz Tunguz Blog)

Worthy Recommendations

The Power Law: Venture Capital and the Making of the New Future, recommended by Arvind Purushotham, head of Citi Ventures.

The Power Law: Venture Capital and the Making of the New Future. “The Power Law: Venture Capital and the Making of the New Future” does an excellent job highlighting the importance of discovery and learning in the venture capital and startup world. Mallaby perfectly illustrates the laws of power that control which points of discovery succeed in venture capital and which ones don’t. His analysis of the highest highs and lowest lows adds color to the venture world and how it dictates how we see our future.”, Geri says.

Jobs

SEO Team Lead at LeadVenture™ (Mexico; Remote)

Demand Generation Manager at Directive (Mexicali, Baja California, Mexico; Remote)

Strategy and Transformation Lead at VivaAerobus (Mexico City; Hybrid)

CTO/Head of Technology at Listopro (Medellin, Antioquia, Colombia; Hybrid)

Managing director at Netvagas (São Paulo, São Paulo, Brazil; Hybrid)

Deals

These startups and companies received capital this week:

Valuelist | Wealthtech | Venture. Chilean wealthtech company Valuelist is close to closing a USD$750,000 financing round for its platform that helps organize various financial assets. The startup recently received a USD$600,000 investment from Synapse. Valuelist's platform allows real-time visualization and monitoring of investment operations and is primarily used by high-net-worth individuals and financial advisors.

House & Flats | Real Estate | Crowdfunding. Colombian real estate investment platform House & Flats has successfully concluded its financing round, raising over USD$256,000 through crowdfunding. With the funds obtained, House & Flats plans to expand its platform, attract new customers, and increase its presence in regional countries, with a focus on Buenos Aires.

Wareclouds | Logistics | Venture. Chilean startup Wareclouds has raised USD$2 million in its third funding round. The round was led by New York-based firm 2048 Ventures, which contributed USD$1.8 million, while ChileGlobal Ventures provided USD$200,000. Wareclouds connects households with small and medium-sized enterprises (SMEs) and e-commerce businesses, allowing them to store inventory and streamline logistics.

TIMining | SaaS | Series A. Chilean startup TIMining has raised USD$10 million in funding to expand its client base and increase revenue. Led by Kayyak Ventures, the round included investors LarrainVial and the Luksic family. The company offers real-time data analysis and simulation to improve productivity and safety in around 50 mines, including those owned by BHP Group, Anglo American Plc, and Codelco.

Luzia | AI | Not specified. Spanish startup Luzia has secured €9.5 million in funding to strengthen its position in the AI-based technology market in Latin America and other regions globally. The company's AI assistant is widely used on platforms like WhatsApp and Telegram, transcribing audio into text and generating images. Luzia's efforts are focused on Spain and critical Latin American territories. The funding round was led by Gasol16 Ventures and Khosla Ventures.

Leucine | Pharma SaaS | Series A. Pharma B2B SaaS Leucine has raised USD$7 million in a Series A funding round, led by Ecolab. The platform helps pharmaceutical manufacturers with batch planning, process modernization, and transitioning to digital formats. They have successfully implemented their solutions in over 300 facilities across 10 countries, including Brazil and Mexico.

Nexu | Fintech | Series B. Mexico-based automotive financing platform Nexu has raised USD$20 million in Series B funding. The round was led by Valor Capital, FinTech Collective, and Endeavor Catalyst, as well as previous investors. The company offers a digital and real-time financing experience for car buyers, using its proprietary credit and risk scoring system to simplify the purchasing process.

Klabin | Paper manufacturing | Debt financing. Brazilian paper company Klabin and its Austrian subsidiary have secured a USD$595 million credit facility with the help of Clifford Chance LLP and local firm Pinheiro Guimarães. The credit facility will provide financial support to Klabin and its subsidiary.

Payface/SmileGo | Payments | M&A. Payface, a leading startup in facial biometric payments in Brazil, has acquired its competitor, SmileGo. SmileGo is known for biometric payments with white-label cards used by retail chains.

Vopero | Marketplace | Venture. Vopero, a startup based in Uruguay, closed a USD$4 million funding round. Founded in 2020, the company offers 'resale as a service' and has developed a comprehensive solution for the fashion resale marketplace. Sellers use the Vopero app to list their items, which are then processed and sold on the platform.