Is Tesla saying goodbye to Nuevo Leon's new factory?

SMEs in LatAm use at least one fintech solution. LatAm's is in love with Fintech. The challenges of scale in VC. Hedge funds in VC are selling startups. Lessons from a Multi-Stage VC fund.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

Tesla pauses new factory project in Nuevo Leon, Mexico

The promise of an electric vehicle revolution in Nuevo León, Mexico, remains uncertain as Tesla's USD$10 billion investment in the region has yet to begin construction.

Despite Elon Musk's announcement of producing an affordable electric vehicle in Mexico, the company's focus seems to be on the Austin Gigafactory in Texas. While there are concerns about the production delays, local authorities remain optimistic, stating that Tesla owns the land and is processing federal permits.

The vision of Nuevo León as an epicenter of electric vehicle innovation depends on various factors beyond local borders.

Vía Contxto

24 million SMEs in LATAM use at least one fintech solution

Small and medium-sized enterprises (SMEs) in Latin America face a financing deficit of USD$1 trillion. This presents an opportunity for fintechs to provide innovative solutions and overcome traditional barriers to accessing financial services. Currently, around 24 million SMEs in Latin America use at least one fintech solution, with digital payment acceptance being the most prevalent.

Fintechs play a crucial role in modernizing business processes through automated solutions and facilitating access to financial services. However, challenges such as reliance on personal financial products and inadequate user experience still exist.

The future of fintechs in Latin America is moving towards diversified business models and comprehensive platforms, which could greatly improve financial services for SMEs and drive economic transformation in the region.

Vía Contxto

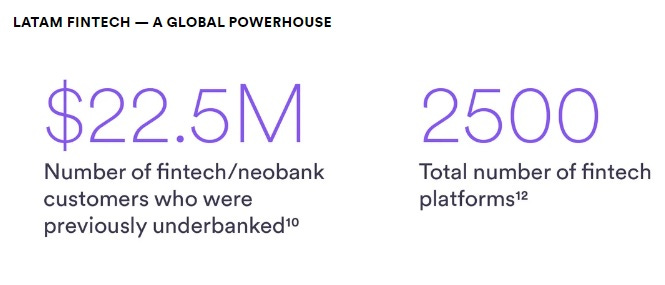

Latin America Embraces Digital Finance and the Next Internet Era

Latin America is embracing digital finance and the next era of the internet. Stablecoins and blockchain technology are enabling easier movement and ownership of value globally. Latin America, with its large population, strong developer base, and demand for financial services, is playing a leading role in this shift.

The region's underbanked population, policy support, and widespread use of the dollar make it an ideal fit for stablecoin adoption. Circle, a fintech company, offers stablecoins and developer tools to create new financial services that are interoperable through a global operating system for money.

Examples of Latin American fintechs using Circle's stablecoin, USDC, include Mercado Libre, Airtm, Lemon, Ripio, and more. The vision is to create internet-native financial infrastructure that enables frictionless value exchange and financial interoperability.

Vía Circle

Quick News

Claro Peru opens data center valued at USD$50 million

The company owned by America Movil, one of the largest mobile and telecommunications companies in the world, has opened the first phase of its Tier III data center in Lima. The initial stage includes a 250m2 IT room with 104 cabinets and renewable energy certification.

Why it matters. The company aims to invest in the digital economy of Peru and become a leader in the country's digital transformation.

The importance of Peru. There is a possibility that the Lima facility will host an Oracle cloud region for Peru in the future. (Contxto)

Enverse: recognized as one of the best startups in LATAM

Chilean startup Enverse, specializing in hyper-realistic metaverses in architecture, experienced significant growth of 300% in the last semester of 2023, reaching a user base of 50,000.

Highlights. They were recognized as one of LATAM's fastest-growing startups by the Founder Institute in Silicon Valley.

Business model. Enverse collaborates with urban planners and architects to create metaverses, focusing on retail and health segments. They have expanded their presence in Latin America, Europe, and Asia.

The future is medical e-learning. Enverse is also venturing into the healthcare field with Medical E-Learning, aiming to provide medical updates to doctors in Latin America. (Contxto)

Snowflake expands to Colombia to boost data usage in LatAm

The data cloud giant has officially launched its operations in Colombia as part of its expansion plans in Latin America.

Business model. Snowflake provides access to large amounts of data, tools, applications, and services through its Snowflake Data Cloud platform, enabling secure collaboration between startups and large companies.

A platform for AI. The platform is essential for AI and machine learning, allowing organizations to build and deploy ML models and transform them into interactive applications.

Meet the Country Manager. Snowflake's expansion in Colombia will be led by Country Manager Ernesto Serrano, who will focus on sales and customer service. (Contxto)

Brazil inaugurates pioneering laboratory in LatAm for sustainable food innovation

The "Tropical Food Innovation Laboratory" has been opened in Campinas, São Paulo, marking a significant step towards sustainable food.

Why it matters. The laboratory, a collaboration between five leading companies, aims to develop alternative foods such as cultured meat, plant-based milks, insect proteins, and chicken-free meat.

Highlights. It focuses on creating an innovation ecosystem and promoting foods that are healthy, safe, accessible, tasty, environmentally sustainable, and transparent. (Contxto)

Yucatán Shuts Down Government Systems Due to Cyberattack

The Yucatán State Government in Mexico has experienced a second cyberattack this year, prompting concerns about its cybersecurity measures.

Highlights. The central system remains unharmed, but as a precaution, all departmental portals have been temporarily disabled. Outdated network systems may be to blame for the vulnerability.

Why a Cybersecurity Law is needed. To mitigate such risks, industry leaders suggest implementing a coherent Cybersecurity Law and updating bureaucratic digital systems, as seen in the successful initiative in Michoacán. (Mexico Business News)

SoundThinking Expands into Latin America with Launch of ShotSpotter in Montevideo, Uruguay

Leading public safety technology company, SoundThinking, Inc., has announced the deployment of its acoustic gunshot detection system, in the capital of Uruguay.

About the system. The system will be integrated with existing technologies in the city to enhance police response to gun violence.

Why Uruguay? The deployment is part of Uruguay's comprehensive approach to addressing growing gun violence in Montevideo.

Expanding to LatAm. This deployment marks the expansion of ShotSpotter into the Latin American market, and a Spanish-language version of the ShotSpotter application will be rolled out. (GlobeNewswire)

Withu chosen as Visa customer loyalty partner across Latin America & the Caribbean

WithU has partnered with Visa in the Latin America & Caribbean region to offer Visa cardholders free access to their on-demand workouts, marking Visa's first expansion into the fitness sphere.

Highlights. Visa Platinum, Visa Signature, and Visa Infinite credit and debit cardholders in 22 countries across Latin America & the Caribbean will receive six months of free access to WithU's library of 1,500+ workouts as part of Visa's customer loyalty program.

About the partnership. This partnership between WithU and Visa aims to provide quality coaching and fitness content to millions of Visa customers, with plans to expand the partnership into other territories in the future. (PR Newswire)

Oracle Becomes the First Hyperscaler with Two Cloud Regions in Chile

Oracle has opened a second cloud region in Chile, making it the first hyperscaler to have two regions in the country, enabling organizations to strengthen business continuity and meet data residency requirements.

Highlights. The new Oracle Cloud Valparaíso Region offers a wide range of cloud services and capabilities, including low-latency networking and high-speed data transfer, to help organizations modernize their applications and migrate workloads to the cloud.

Why Chile and LatAm. Oracle's investment in multiple public cloud regions across Chile and Latin America demonstrates its commitment to the region and supports the country's digital transformation, providing resilience, security, and high performance for industries across the country. (PR Newswire)

Rocketfy, a Colombian startup, expands to Mexico

With a projection of 33% compound annual growth in digital commerce, Rocketfy has revealed its plans to strengthen its presence in Mexico. The goal is to facilitate the online sales process for Mexican entrepreneurs, generating significant changes in user experiences.

Rocketfy’s plans. Rocketfy aims to quintuple its sales in Mexico by 2024, with a focus on integrating advanced technologies and developing business capabilities. This translates into support for Mexican SMEs and also generates at least 200 remote jobs in Colombia.

Highlights. To support this expansion, Rocketfy plans to invest approximately USD$1 million, impacting about 100,000 small businesses and SMEs. To start selling through this platform, entrepreneurs must enter rocketfy.mx and follow the registration steps. (Contxto)

Capgemini boosts its strategy in LatAm with a new CFO

Capgemini, a technology and outsourcing consultancy, has announced the appointment of Nive Bhagat as its new Chief Financial Officer (CFO), effective from January 1, 2024, succeeding Carole Ferrand, who has been CFO since 2018.

About the new CFO. With more than 13 years at Capgemini, Bhagat currently serves as CEO of Cloud Infrastructure Services. She worked at Infosys Technologies and KPMG and since 2022, she has been a non-executive director of Schneider Plc.

Why it matters. This change is significant for the company’s strategy in Latin America, where Capgemini has been expanding its presence and operations. Indeed, Bhagat was key in the expansion the company had in the region since 2018. (Contxto)

Finds

tools, websites, and accessories

Klu. Klu is a tool that allows users to seamlessly search and connect multiple Gmail accounts, as well as other apps like Notion, Slack, Drive, and more. It offers features such as instant email summarization, quick insight into messages, and the ability to ask questions about Gmail content.

Planfit. Planfit is a free AI-powered personal training app that provides personalized workout plans tailored to individual goals, strength, and gym setup.

Forefront (AI Stories). AI Stories is a new tool that allows users to create with AI. It offers an AI assistant that can perform various tasks such as browsing the internet, chatting with files, and customizing assistants.

Food for Thought

Tidal Waves in Venture Capital

This article discusses the current trends and future predictions for the VC industry. It highlights the challenges of scale in VC, with many funds competing for a limited number of high-return deals. This, coupled with lower revenue multiples for companies, has led to lower returns for VC investors.

The article also explores the potential use of data science and AI in the VC investment process, as well as the increasing frequency of VC investments. In terms of predictions, the article suggests that smaller firms and solo general partners (GPs) could utilize AI to compete with larger investment platforms.

It also discusses the possibility of VC becoming a more traditional asset class, the potential comeback of "calm funds," and the impact of increased activity from corporate venture capital (CVC) and cloud hyperscalers. Overall, the article argues that these trends and predictions will bring significant changes to the VC and startup ecosystem. (East Wind)Why hedge funds are packing up and leaving VC

Hedge funds that were active in VC during the pandemic are now selling startups in the secondary markets as the market turns south. Players in VC who were investing out of large commingled public and private funds are being forced to walk away from their VC strategies as investors withdraw capital. Hedge funds are struggling to exit private investments quickly and are resorting to secondary share sales, although these markets are relatively immature.

Some hedge funds are using financial engineering techniques to buy themselves time, but the problems faced by hedge funds are bad news for the VC ecosystem. The investment pace of hedge funds has already dropped significantly, and they are likely to cut their losses in the venture asset class for now.Hedge funds tend to be nimble and can shift their investments to other asset classes such as public stocks or credit. Unless interest rates decrease, their participation in venture capital is expected to continue declining. (PitchBook)

Navigating the High-Stakes Game of Venture Capital: Lessons from a Multi-Stage VC Fund

The article discusses the case of a venture capital fund that adopted a diversified investment strategy. The fund invested millions of dollars into hundreds of startups, hoping that some would succeed.

However, many of these startups were not prepared to handle such substantial investments, and the fund's post-investment support was inconsistent. As a result, several startups struggled, and the fund's success rate was less than ideal.

The article emphasizes the importance of adequate preparation, post-investment support, and a strong partnership between investors and startups in venture capital. (Trace Cohen Angel Investor / Family Office/ VC)

Worthy Recommendations

Clear Thinking: Turning Ordinary Moments into Extraordinary Results, recommended by Lindsay DeLarme, Head of Corporate Communications & Branding of Oaktree Capital.

Clear Thinking. “Shane Parrish provides readers with insights and practical tools that can help them learn how to think and act more deliberately. The book is an engaging read, as Parrish raises thought-provoking questions and weaves in personal experiences and relevant stories about prominent figures. Ultimately, he seeks to help readers turn off their mental autopilots, reset their default settings, and improve their decision-making in both their personal and professional lives.”, Lindsay says.

Jobs

Business Development Sr Associate at WeWork (Mexico City, Mexico; On-Site)

Country Start Up Specialist at Medpace (Mexico City, Mexico; On-Site)

Senior Account Executive at Clara (Monterrey, Nuevo León, Mexico; Hybrid)

Business Development Manager at Aplazo (Mexico City Metropolitan Area; Hybrid)

Business Development Manager at IntVentures (Mexico; Remote)

Deals

These startups and companies received capital this week:

Conexa | Healthcare Platform | Not specified. Vivo Ventures, the corporate venture capital fund of Vivo, a leading telecommunications company in Brazil, has announced a R$25 million investment in Conexa, the largest digital health ecosystem in Latin America.

Kapital | Fintech | Series B. Kapital, a bank and technology platform based in Mexico City, has raised USD$40 million in Series B funding and secured USD$125 million in debt financing. The company, founded in 2020, aims to provide small businesses with financial visibility through data and AI.

Yalo | AI | Series C. Mexican company Yalo, a pioneer in AI-driven conversational commerce, has secured a USD$20 million investment from Glisco Partners to deepen its AI capabilities and drive further growth. Yalo aims to revolutionize the way businesses engage with customers by leveraging AI and messaging apps like WhatsApp.

Vammo | Electric Mobility | Series A. Brazilian electric mobility startup Vammo has raised USD$30 million in a Series A funding round led by monashees, with participation from Construct Capital, 2150, and Maniv Mobility. The funds will be used to expand operations in São Paulo and enter other markets such as Colombia and Mexico.

Solvento | Logistics | Seed and Debt Financing. Mexican logistics startup Solvento has secured a USD$50 million debt line from Lendable and raised USD$3.5 million in seed funding led by Quona Capital. The company also announced the launch of Solvento Audita, an AI-powered audit and billing software that aims to bring transparency to the supply chain.

Deep Agro | Agro Tech | Seed. Argentine AI startup Deep Agro has raised USD$2 million in an initial financing round. The company aims to expand to Brazil in February 2024 and explore opportunities in the United States. Deep Agro has developed an intelligent system that minimizes the use of agrochemicals in farming.

Letrus | EdTech | Seed. Brazilian ed-tech startup Letrus has successfully raised USD$7.3 million in funding, led by Crescera Capital, and saw participation from Owl Ventures. Letrus has developed a platform powered by AI to enhance students' reading and writing skills in schools, providing instant feedback and recommendations.

Uncover | MarTech | Seed. Uncover, a martech company specializing in data science solutions for marketing, recently received a USD$7.5 million investment and plans to expand its team. The company's platform uses data integration and AI to optimize advertising investments.

Pawer | Pet Tech | Seed. Chilean pet-tech startup Pawer has closed a bridge financing round of USD$100,000 to expand its business in Chile and enter the Peruvian market. The company offers a range of services through a mobile app, including veterinary insurance and assistance for individual users and companies.

Supra | Fintech | Not specified. Citigroup has led an investment round in Colombian startup Supra, which focuses on cross-border payments and treasury solutions for SMEs involved in imports and exports. The investment will help Supra expand its operations and strengthen its role as a payment aggregator.

Avify | SaaS | Not specified. Costa Rican startup Avify has raised USD$800,000 in a pre-seed funding round. Avify offers a platform that simplifies inventory management for businesses by integrating sales through WhatsApp and updating inventory in real time. The funding round included contributions from various investors and will be used to enhance Avify's platform and expand its operations in Central America.