Foreign Direct Investment reached a historic record in Latin America

Insurance companies loves LATAM. USD $1 billion ready for LATAM companies. The rise of digital nomads. How to deal with cash flow problems.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

Liquido: The unified solution for payments in Latin America

Liquido, a payment platform founded by Shanxiang Qi and Mengke Li, aims to unify and simplify payment methods in Latin America.

Inspired by successful Asian platforms like WePay and WeChat, Liquido offers integrated solutions on popular platforms like WhatsApp.

The platform eliminates the need for multiple integrations and offers customized solutions and 24/7 customer service. With plans for geographical expansion and investments of over USD$26 million, Liquido aims to become the future of payments in the region.

Vía Contxto

Why LATAM is the best region for insurers?

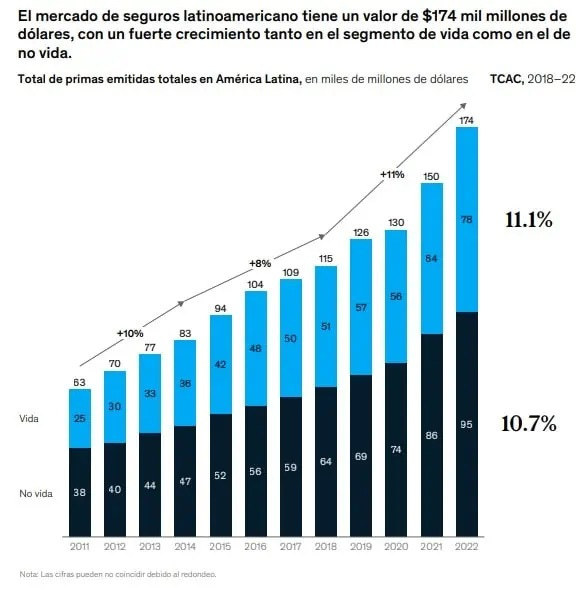

Latin America has become an attractive market for insurance companies, with the region's insurance market valued at USD$174 billion. Despite the impact of the COVID-19 pandemic, the insurance sector in Latin America showed resilience.

However, profitability for insurers decreased from 22.3% in 2019 to 16.6% in 2022. Insurance penetration in Latin America is increasing, but the majority of the population still does not have life insurance or insured vehicles.

The report highlights the emergence of insurtech companies collaborating with established insurers. Local insurance companies dominate the market, but new startups are adding competition and innovation. Operational efficiency remains a challenge for insurers in Latin America.

Vía Contxto

Quick News

What are the benefits of DidiCard, Didi’s new card?

Chinese ride-hailing giant Didi is expanding its offerings in Mexico with the launch of its first-ever credit card, called DidiCard.

Highlights. The virtual card can be acquired within five minutes through the Didi Passenger and Didi Food apps and offers a credit line of $3,000 pesos.

Value proposition. Users can earn 3% cashback on purchases made through Didi and Didi Food, and the card also provides special discounts through partnerships with companies like Cinemex and Booking. (Contxto)

Cabify introduces the second edition of Women Tech Dating to empower the role of women in technology

Spanish multimobility platform Cabify is hosting the second edition of Women Tech Dating, an event aimed at showcasing the opportunities for women in the tech industry.

The event. The event includes mentorships, online masterclasses, and expert panels led by female leaders in the tech sector.

When. From October 24th to November 7th.

Why it’s important. Cabify has partnered with Female Startup Leaders in Spain and Laboratoria in Latin America to expand the reach of the initiative. The company is committed to promoting gender equality and increasing diversity in its tech teams. (Contxto)

Colledge boosts Web3 ecosystem in Latin America

Colledge, in partnership with leaders in the Web3 world, has launched a program in Latin America to drive the development of blockchain technology and Web3 applications.

The program. The program focuses on teaching Solidity, smart contract security, and proxy theory, while also providing community mentorship. It aims to equip participants with the skills and knowledge needed to be successful Web3 developers and entrepreneurs.

Where. The program will be held in Mexico City and Bogotá, with a limited number of slots available.

Why it’s important. This initiative presents a valuable opportunity for Latin American developers interested in blockchain development and Web3 entrepreneurship. (Contxto)

Kaszek Ventures has USD $1 billion allocated for LatAm companies

Latin America's leading venture capital firm, Kaszek Ventures, has raised USD$1 billion this year and is well-positioned to take advantage of emerging market opportunities.

A challenging startup investments ecosystem. Despite a significant decline in global startup investments, Kaszek has managed to invest in seven companies, including Colombian fintech Cobre.

Highlights. While many startups are resorting to high-interest loans due to a funding shortage, Kaszek sees potential in climate tech and artificial intelligence startups. Despite the current challenges, Kaszek remains optimistic about a rebound in the region's startup ecosystem in the coming months. (Contexto)

The Mexican startup Bravo expands to Colombia

Mexican fintech company Bravo has expanded to Colombia, aiming to help over 600,000 individuals settle their overdue debts and gain access to credit.

Objectives. The company plans to invest over COP $179 billion and aims to integrate 27,000 users, settle 24,000 debts, and grant 7,500 loans within the next 15 months.

Value proposition. Bravo's process involves evaluating the client's financial situation, creating a savings plan, and offering a loan to settle debts if the client meets certain criteria. (Contxto)

Unergy announces opening of its first office in Europe

Latin American cleantech and fintech startup, Unergy, is opening its first branch in Europe to expand its presence in countries such as Spain, France, Great Britain, the Netherlands, and Switzerland.

Value proposition. Unergy offers low-risk investments with a guaranteed 7% annual return by financing mini-solar farms through a blockchain and AI platform. The company selects strategic locations with high solar radiation, stable regulatory frameworks, and financing needs.

The numbers. Each project requires an initial investment of around USD$1 million and generates net profits of USD$150,000 to USD$180,000 per year. (Contxto)

Rocket Lab, a Mexican Adtech startup, is expanding to Chile

Rocket Lab, a Mexican firm specializing in mobile app advertising, is expanding its presence in Chile. It has partnered with local companies Falabella and Tapp to revolutionize mobile app growth and monetization.

Value proposition. Rocket Lab uses advanced algorithms and AI to display application ads on mobile devices, targeting the perfect user for each brand.

Highlights. Rocket Lab aims to grow by 400% in Chile and expand its client base to six by the end of the year. The company sees Chile as a hotbed for innovative technologies and a favorable environment for adopting apps and digital payments. Its partnership with Falabella App aims to boost profitability by increasing transactions. (Contxto)

Huawei and Amexcid drive the digital future of startups in Latin America

Huawei, in collaboration with Amexcid and SRE, has concluded its Huawei Spark 2023 startup acceleration program in Latin America.

The program. The program focused on emerging tech startups in Mexico, Chile, Peru, and Colombia, with an emphasis on cloud computing solutions. Out of the 100 participating startups, 48 were selected to receive financial support, ranging from $2,000 to $100,000, as well as access to Huawei Cloud solutions, mentorships, and networking opportunities. The program aims to promote sustainable digital development and entrepreneurship in the region. (Contxto)

Foreign Direct Investment reached a historic record in Latin America

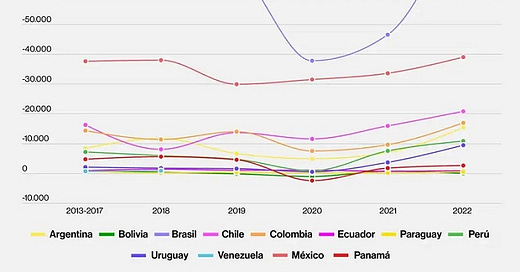

Foreign Direct Investment (FDI) in Latin America and the Caribbean reached a historic record of USD$224,579 million in 2022, marking a significant increase of 55.2%. This surge was mainly driven by reinvestment of profits and growth in the services sector. However, the report warns that this growth may not be sustained in 2023.

Highlights. FDI accounted for 4.0% of the regional GDP. Brazil led in FDI reception, followed by Mexico, Chile, Colombia, Argentina, and Peru. The services sector received the majority of FDI, but there was also an increase in manufacturing and natural resources sectors.

The US leading the way. The United States and the European Union were the leading investors, and there was a notable increase in FDI from within the region. Latin American transnational companies also saw a historic level of FDI in 2022. (Contxto)

Telefónica to merge its networks in Colombia with Tigo

Telefónica has received approval for a merger with Tigo in Colombia. The agreement allows for the sharing of network infrastructure and spectrum usage rights.

Highlights. The merger will create a new company with shared infrastructure, but both companies will continue to compete in wholesale and retail markets. The Superintendence of Industry and Commerce granted the authorization, but certain conditions were established to ensure fair competition.

Why it’s important. The merger aims to optimize the operation of mobile networks and spectrum while strengthening the companies' economic position. However, telecommunications operators express concern about the high costs associated with the upcoming 5G network auction in Colombia. (Contxto)

Mexico at the forefront: The rise of digital nomads and the transformation of modern work

Mexico is emerging as a leader in the digital nomad movement, with 82% of workers already enjoying flexible work.

A friendly country for remote workers. The country has launched visa programs for remote workers, allowing them to collaborate with international organizations and reside in Mexico for up to six months.

Why Mexico. The trend of digital nomadic work is expected to continue growing. Mexico's cultural richness and geographic position make it well-positioned to benefit from this trend. (Contxto)

Bogota to host the Techstars Startup Weekend

Colombia's capital, Bogotá, is preparing to host Techstars Startup Weekend, a global event that provides an educational and collaborative environment for entrepreneurs to present and develop new ideas.

The event. The event, taking place from October 20 to 22, will allow local entrepreneurs to connect with others, learn from experts, and turn their ideas into reality.

Value proposition. Participants will form teams, develop minimum viable products, validate business models, and receive feedback from mentors. The event will also include training sessions and workshops on topics such as market validation and business development.

When. October 20th to 22nd. Tickets can be purchased until October 17. (Contxto)

Kran arrives with nanobubble technology in the U.S.

Chilean startup Kran has achieved international expansion with its nanobubble technology, which can save water, energy, and contribute to ecosystem restoration.

Value proposition. The technology has various applications, including extending the shelf life of oranges, reducing water usage in industries like mining and food, and improving irrigation efficiency.

Highlights. Kran has experienced significant growth, with partnerships with Chilean universities and 30 ongoing projects worldwide. The company has won an innovation program by AB InBev Brewery and aims to expand its technology to other countries. (Contxto)

Wayra, Iker Casillas, and Pau Gasol will boost sports and health startups in LatAm

Telefónica through Wayra, SportBoost, and Gasol16 Ventures have formed an alliance called GameChangers3 to promote entrepreneurship in the sport, health, and well-being sectors in Latin America.

Why it is important. The alliance will invest up to €1 million in innovative startups specializing in health, well-being, sport, and nutrition. Wayra will provide support to startups through its business units and offer access to its investment ecosystem and workspace.

The opportunity in North America. SportBoost and Gasol16 Ventures will provide startups with access to sports contacts and opportunities to scale in the North American market. Startups can submit their proposals on GameChangers3. (Contxto)

Chile reached 300 financial technology companies according to the Finnovista Fintech Radar 2023

Chile is becoming a leading hub for financial innovation in Latin America, as showcased at the Finnovista Fintech Radar Chile 2023 event.

Findings. The report presented at the event revealed that Chilean fintech startups have experienced significant growth, with a 29.5% annual increase since 2021, totaling 300 companies. Over half of these startups focus on payments, remittances, financial management, and lending. Additionally, 54.7% of the fintechs in Chile already integrate advanced technologies, leading adoption in the region. However, they face challenges in international expansion and scaling.

Chile is a powerful player in Fintech. Chile's burgeoning fintech ecosystem, venture capital investments, and government support position the country as a powerful player in the industry. (Contxto)

South Summit Brazil begins the registration process for the Startup Competition 2024

The South Summit Brazil Startup Competition for 2024 has been announced, following the success of last year's edition. Over 2,000 startups from 86 countries participated in the competition, with a Spanish startup called Airway Shield winning the main prize.

The event. The event, organized by IE University and the Government of the State of Rio Grande do Sul, has seen exponential growth, attracting thousands of attendees, entrepreneurs, speakers, and investors. The competition aims to strengthen connections between startups and investors, offering finalists the opportunity to present their projects and network with potential investors. (Contxto)

Startup LicitaLab begins expansion into Colombia

Chilean startup LicitaLab is expanding into Colombia after being selected for the GoGlobal program.

Business model. The company offers specialized software for public procurement process management and aims to modernize government acquisitions. LicitaLab's platform provides automated tools for searching tenders, streamlining purchasing processes, and offering business intelligence.

Highlights. The startup gained its first users during the COVID-19 pandemic and currently has 500 active clients in Chile and approximately 100 in Peru. LicitaLab's expansion into Colombia is part of its goal to enhance the experience of government procurement and provide better technology for all providers. (Contxto)

Finds

tools, websites, and accessories

Framer. Framer allows designers to build and publish responsive websites without needing to write code, making it similar to Figma but with the added benefit of actually building the site. With features like AI-generated templates, localization options, powerful scroll effects, and CMS capabilities, Framer offers a powerfully simple solution for building professional sites with best-in-class SEO, performance, and hosting.

Humata. Humata is an AI-powered tool that helps teams read and summarize technical papers quickly. It allows users to upload unlimited files of any size and provides fast answers to questions. The tool also highlights citations to build trust and provides unlimited options to rewrite and customize summaries.

Yaara. Yaara.ai offers a comprehensive suite of AI-powered tools that can significantly enhance the efficiency and quality of writing, from generating engaging content to overcoming writer's block and conducting research. With Yaara.ai, writers can save time and increase productivity by producing 10x more content while maintaining high quality, thanks to features like the Long Form Writer and the Marketing Frameworks.

Food for Thought

The Art Of Venture Exit Planning In A Tough Climate

VCs are facing challenges in achieving successful exits for their portfolio companies in the current tough economic climate. This has led to cash flow concerns and a need to re-evaluate exit strategies. To maximize success and returns, investors and founders should align their goals early, discuss potential exit strategies, and prepare the business accordingly.

Timing is critical, and it is important to monitor market trends and economic conditions to strategically time the exit. Building strategic relationships and expanding networks can enhance the likelihood of a successful exit. In a challenging market, focus on what can be controlled and double down on building value.

Strengthening the team and implementing governance structures can help reassure potential buyers and secure valuation expectations. Overall, patience and a focus on the fundamentals are key until market conditions improve. (Forbes)How Tech Companies Can Deal With Cash Flow Problems

Cash flow issues are a common problem for tech companies, with 16% of businesses failing due to these problems. Rapid growth, expanding workforce, irregular revenue, and subscription challenges can all contribute to cash flow issues.

To address these problems, tech companies can optimize R&D expenditures, master customer billing cycles, form strategic partnerships, consider external funding options, or even explore Chapter 13 bankruptcy. Each company will face unique challenges, but implementing proactive strategies can increase the chances of success. (Readwrite)

Women and underrepresented founders aren’t going to wait for the VC industry to transform itself

The article discusses ways for women and underrepresented founders to overcome bias in the VC industry. It suggests that founders should prepare growth-related responses to risk-related questions during the due diligence process. It also encourages founders to track and communicate the evolution of their strategies to demonstrate their ability to learn and adapt.

Additionally, the article advises founders to explore alternative funding options beyond venture capital and to participate in startup support programs. While these tips can help founders in the short-term, the article emphasizes the need for investors to address the bias within the funding system by hiring more diverse investment teams and improving evaluation processes. (TechCrunch)

Worthy Recommendations

Founder vs Investor: The Honest Truth About Venture Capital From Startup to IPO, recommended by Geri Stengel, President, Ventureneer.

Founder vs Investor: The Honest Truth About Venture Capital From Startup to IPO. “Elizabeth Zalman, founder, and Jerry Neumann, investor, reveal the reality of building a successful venture-backed company. Founders and investors are motivated by different things. This misalignment can result in the founder getting fired.”, Geri says.

Jobs

Solution Architect at VTEX (Mexico City, hybrid)

Senior Product Manager at Yaydoo (Mexico City, hybrid)

Director de CRM - Ecommerce at Michael Page (Medellín, Antioquia, Colombia, hybrid)

Sr B2B Marketing Manager at Kueski (Mexico, remote)

Growth Lead at Digital@FEMSA (Monterrey, Nuevo León, Mexico; remote)

Deals

These startups and companies received capital this week:

Lipigas/Rocktruck | Energy | M&A. Chilean gas distribution company Lipigas has invested USD$13.4 million in logistics startup Rocktruck, acquiring a 70% stake in the company. Lipigas plans to acquire 100% ownership of Rocktruck within five years and will contribute its logistics and digital expertise to help the company achieve its growth goals.

Brota | AgroTech| Series A. Brazilian startup Brota has closed a Series A investment round, raising R$1 million, bringing their total funding to R$3.27 million. The company, which sells plants for urban gardens, has seen rapid growth, doubling its revenues in a year, launching eight new products, and expanding its customer base to 50,000.

Galgo | FinTech | Venture. Chilean fintech company Galgo has secured a USD$40 million investment round led by Mexican fund Nazca, with the participation of Grupo Auteco, WIND Ventures, Güil Mobility Ventures, Dalus Capital, Kayyak Ventures, Fynsa, Buena Vista Capital and Amarena VC. The startup initially offered financing to the foreign population and expanded to include financing for motorcycles and cars.

Bia | Energy Tech | Series A. Colombian virtual energy marketing company, Bia, has received a USD$16.5 million capital investment from Kaszek, a leading venture capital firm in the region. Bia aims to improve energy consumption management by placing the user at the center and using innovative technology.

CondoConta | Fintech | Venture. Brazilian fintech company CondoConta has secured an additional USD$5.8 million in funding from EXT Capital. CondoConta offers financial services to approximately 3,000 condominium communities in the country, including bank accounts, financing, and expense management.

Cobre | Fintech | Venture. Colombian fintech startup Cobre has raised USD$13 million in a funding round led by Kaszek, bringing its total financing to over USD$30 million. Cobre aims to expand its services to small and medium-sized businesses in Latin America. The company's corporate treasury platform is already popular among financial directors in Colombia, and with the new funds, Cobre plans to improve and adapt its product for smaller businesses.

Drip | Fintech | Venture. Fintech company Drip has secured a USD$8 million investment from SRM Asset, a venture capital firm. Drip specializes in payment installment solutions through Pix and will also utilize SRM's Wefin platform for credit operations. The investment will help Drip expand its services and provide better benefits to users.

Bricksave/Macondo | Fintech/Real Estate | M&A. Bricksave, a real estate investment fintech, has acquired Colombian proptech startup Macondo. The acquisition will allow Macondo users to access the first property sponsored by Bricksave in Chicago. This acquisition will also help Bricksave reduce the minimum investment amount, making real estate investment more accessible to a wider audience.

SiloReal | AgriTech | Venture. Argentine agtech startup SiloReal has secured a USD$1.5 million investment to expand and refine its technology. SiloReal offers a revolutionary solution in silobag storage, using technology to provide identity and tangible evidence of the existence and condition of the bags.

Yooga | SaaS | Seed. Brazilian restaurant operation management system, Yooga, has raised USD$2.3 million in seed capital in its first institutional funding round. Yooga offers software for restaurants to automate their operations, manage orders, provide delivery services, and control inventory and cash flow.