Brazil is in the top 10 countries with the most unicorns

Bling & Amazon join forces. LatAm's AI startups expected to continue attracting investors in 2024. Ideas2IT expands to LatAm. Logistics companies in Mexico grow due to ecommerce.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

Bling and Amazon join forces to enter SMEs into the Mexican marketplace

Bling has announced its integration with Amazon in Mexico, allowing small and medium-sized businesses to immediately connect to one of the largest marketplaces in the world. This integration provides these businesses with access to 50 million users in Mexico and millions more in Latin America and the rest of the world.

Mexico is experiencing significant growth in e-commerce, and with 4.2 million SMEs contributing to 52% of the country's GDP, there is a great opportunity for these businesses to expand through online sales. The integration with Amazon simplifies sales, customer management, and inventory control for SMEs, and also streamlines the delivery process by allowing them to choose from multiple courier services.

Bling's Director of Operations, Marcelo Navarini, states that this partnership will greatly benefit Mexican SMEs and contribute to their growth. The integration is already available for Bling users, providing immediate access to the vast customer base of Amazon.

Vía PRODU

Startup Financing in Latin America: Challenges and New Funding Strategies for 2024

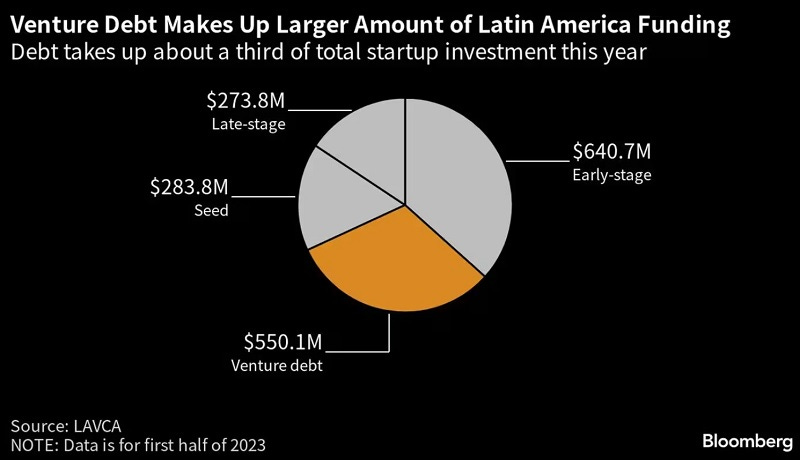

Startup funding in Latin America in 2023 was hindered by high interest rates and economic slowdown, leading companies to seek alternative forms of financing such as venture debt.

While there was caution in later-stage investment rounds, seed and pre-seed investments remained strong. Startups also turned to revenue-based financing and sought investment from non-traditional sectors with excess liquidity. The use of AI as an enabling technology was a major trend in 2023, and it is expected to continue attracting investors in 2024.

Venture capital investment in the region experienced a decline in 2023 but showed signs of recovery in the second half of the year. However, there is a funding gap for later-stage companies in Latin America, which could hinder their long-term scalability.

Vía Bloomberg en línea

Brazil is in the top 10 countries with the most unicorns

The North American region leads in the number of startups that have achieved unicorn status, reaching 615, according to the StartupBlink report.

Globally, there are unicorns in 51 countries; the United States has the most, with 594, representing more than 50% of the global total, and Brazil is the best-positioned Latin American country in this ranking, with 13.

China ranks second with 144 unicorns, despite having a larger population, while India, the United Kingdom, and France complete the top five with 68, 46, and 29 unicorns, respectively.

The Top 10 of 2023 is completed by Israel, Germany, Canada, Brazil, and Singapore. Asia-Pacific is the second region with the most unicorns, with 267, Europe with 171, and Africa and the Middle East with 35. Latin America and the Caribbean have 25 startups that have exceeded USD$1 billion in valuation.

Vía Republica

Quick News

EBANX Integrates Botón Bancolombia for Enhanced Payment Options

Over 19 million Bancolombia customers and 10 million digital service users will now find online transactions more accessible and straightforward.

About the integration: The integration with Bancolombia, a leading Colombian bank, aims to enhance the online shopping experience for Bancolombia account holders.

About the partnership: The partnership between EBANX and Bancolombia is expected to have a significant impact on digital payments in Colombia, offering growth opportunities for online retailers and improving customer access to global markets. (Contxto)

Connecting companies and social projects in Brazil

The startup Incentiv has launched a platform that offers a strategic affinity calculation between investors and proponents, using filters on location, cause, and type of law of each project, a novelty in Brazil.

Impact: the platform promises to streamline bureaucratic processes, with a focus on generating social impact.

Consolidation: it has more than 160 investing companies and around 3,000 registered social projects, indirectly benefiting more than 2 million people. (Economiasc)

Afya Limited appoints new executive

The startup known for its educational and digital solutions for doctors has announced the incorporation of Daniela Bertocchi as its new Director of Communications and Institutional Relations.

Background: her experience includes teaching and participating in conferences, as well as leadership roles in communications for technology companies in Brazil such as Nubank, Alice, 99, and Quinto Andar.

Innovation and diversity: highlights the high quality of teaching and the digital solutions offered by Afya, and the importance of diversity as a central axis in the business. (Revista Life Marketing)

Facilitating access to the Stock Market for LatAm

Hapi, an application for buying and selling stocks in the U.S. stock market, and Airtm, a digital dollar account, have announced their integration. The collaboration opens the doors of the North American stock market to thousands of Latin Americans, offering a simple and fast process.

Access to the Stock Market: allows any Latin American, regardless of their origin, experience, or capital, to become a shareholder of major global companies and manage their money immediately.

Value proposition: Hapi users can easily add and withdraw funds thanks to the more than 400 ways Airtm offers to handle digital dollars and convert them into local currency.

Goals and expansion: Dusko Kelez, CEO of Hapi, highlights the app’s mission to make investing in the stock market accessible to everyone in Latin America. Rubén Galindo, CEO of Airtm, emphasizes the importance of this integration for financial independence in the region. Both platforms seek to expand their ecosystem of financial solutions in LatAm (Enter.Co)

CAF Financial Inclusion Lab Announces Winners

10 startups focused on migrants were the winners of the fifth edition of the CAF Financial Inclusion Lab (LIF), promoted by CAF, the development bank of Latin America and the Caribbean.

The winners. The award-winning startups for developing digital solutions to improve financial inclusion for migrants were Tu Cambio, El Dorado, Reddo Credit, Ualá, AAvance SAS, Reevalua by Preauth, Págame SAS, Petal, Findo, and Monet.

About the program. In the 2023 edition, the LIF received 197 applications, and 122 passed the first phase. Subsequently, representatives from the 80 allies evaluated these proposals and selected 20 finalists who participated in the ‘pitch day’ on December 13. In the end, the 10 winners were announced who will access acceleration programs from Seedstars and Endeavor. (CAF)

N5 Aims to Transform the Financial Ecosystem

Julián Colombo, the founder of the fintech, asserts that the financial industry requires a very aggressive simplification process; therefore, one should not think of more software but rather think of hundreds of software. With this premise, the entrepreneur solved this problem and created a single platform that has everything a bank needs to operate.

According to the executive: There are five components that every banking institution or insurance company requires: clients, banks, channels, processes, and the integration of all mentioned.

“The magic happens when you see everything together working and see how this incredibly simplified the bank, and it’s just one platform,” Colombo details. (Forbes Centroamérica)

Baaskit, a Chilean company, plans to introduce the "Banking as a Service" model to the Chilean market, focusing on providing businesses, particularly large brands, with embedded financial services.

Value proposition: Baaskit differentiates itself by using API-based technology to seamlessly integrate financial services with client systems, aiming to enhance customer loyalty, brand development, and sales conversion.

Baaskit’s market: Baaskit's target market consists of large enterprises with a significant customer base, offering solutions to improve the customer purchase experience, increase conversion rates, and reduce costs. (Contxto)

Easycancha targets the Colombian and Mexican markets by 2024

The Chilean startup Easycancha seeks to consolidate its operations in two regional countries after a successful 2023. The platform that leads the management of sports spaces has grown in all markets, and in some, it has doubled its operation. In Chile, reservations increased by 24% and are approaching 4 million. The application is also available in Brazil, Argentina, Ecuador, and the United States.

Highlights. More than one million users have used the Easycancha service, which allows them to reserve sports fields in the territories above, including Colombia and Mexico, where it hopes to increase its operation. Ecuador has already registered more than 250,000 reservations, representing an increase of 128%, and a rise of 81% is projected for 2024.

Growth plans. Easycancha wants to grow mainly in Colombia and Mexico next year. In the first, it is increasing, while in the second, it is taking its first steps with a few clubs, but it is a market with a lot of potential that it seeks to consolidate. (DFSUD)

Extendeal offers a shareholding percentage to more than 700 pharmacies in Argentina

Extendeal revolutionizes the world of startups by announcing to its clients that they can participate as shareholders. The digital platform has already become a benchmark in technological innovation by comparing prices in drugstores and pharmacies, selecting the lowest prices, and identifying offers for intelligent purchases. It wants to go further with its collaborative nature to generate a more significant impact.

Highlights. More than 700 pharmacies received the announcement, but it is expected that a thousand independent businesses will be beneficiaries. They are an integral part of what Extendeal offers, which, with this decision, seeks to reward the loyalty of those involved.

Value proposition. The startup wants to unite the community with pharmacies collaboratively for a future in which the industry is more transparent. In addition to the fact that businesses have responded well, users can find the best prices and improve their shopping experience from anywhere without installing an app. (El Cronista)

Banco W launches digital wallet

Banco W announced the launch of Billetera W, its digital wallet with which it will compete in the Colombian market. With this product, natural persons who own a business can conduct transactions at no additional cost. In addition, users will be able to reduce the risk involved in handling large amounts of money.

Objective. Banco W’s objective is to enhance the entity’s ability to offer value options to its clients. To do this, the W Wallet will give them a fast and secure financial experience.

About the new app. The new app allows the payment of utility bills and digital platforms. The service will be available seven days a week, 24 hours a day. Money transfers will be made to any financial institution at no additional cost.

Value proposition. With the W Wallet, you can receive money transfers from abroad and withdraw at Banco W or allied banking correspondents. (La República)

Ideas2IT Expands to Latin America

High-end product engineering firm Ideas2IT is expanding to Latin America, aiming to serve the needs of startups and enterprises in the region's fast-growing tech scene.

About Ideas2IT. With expertise in AI, ML, Chatbots, and Industrial IoT, the company has established a strong reputation as an innovation partner for Silicon Valley startups.

Value proposition. The company offer cutting-edge tech solutions and have developed Thingify.ai, an industrial IoT platform addressing material management and production efficiency issues.

A new tech conferecen in LatAm. Ideas2IT also plans to organize a tech conference in Latin America to foster community growth and provide a platform for developers. (Ideas2IT)

Chile and Colombia show optimism in investments for 2024

The investment platform Tyba, from Credicorp, surveyed more than four thousand people in Chile, Peru, and Colombia to find out the investors’ mood for the year 2024. This third edition of the study measures variables such as interest, confidence, situation, and information, in addition to considering banking and investment alternatives. The results are positive for Chile and Colombia; Peru did not differ much.

About Chile. Chile went from 49 points to 52: 26% of respondents say it will likely invest in the next six months. It represents an increase of 5 points compared to 2021 and 2022.

About Colombia. Colombia did not grow in terms of perception but in banking and investments. There is greater interest in acquiring financial products. 23% want to get out of debt before investing. (DFSUD)

Logistics companies in Mexico grow due to e-commerce

Preference for online transactions has increased among consumers looking to buy products, from clothing or gadgets to cars, turning the digital environment into a reliable space.

The ecommerce Mexican market. This market reached a value of USD$33 billion in 2022, making it the second most important in Latin America after Brazil, according to Statista data.

Industrial parks and logistic companies. Before the pandemic, the Mexican Association of Private Industrial Parks (AMPIP) indicated that between 10% and 15% of total square meters were occupied by logistics companies. This percentage has surpassed 30%, according to a report by The Logistics World.

Mexicans love online purchases. Statista estimates that more than 50% of the Mexican population makes online purchases, with approximately 52 million people as digital buyers in 2022. (El Universal)

Mycobites wins Innovations in Sustainability 2023 program

The Chilean foodtech, a pioneer in producing food made from mushrooms, won this acceleration initiative in the category of ‘the Startup best positioned to receive investment.’

About the program. The program organized by Village Capital and Unilever highlighted the innovation of the startup, founded in 2018 by Juan Enrique Bernstein and Rodolfo Ulloa.

Founders comment. “This will allow us to address other categories such as snacks, superfoods, supplements, sausages, and anything else we can develop with the kingdom of mushrooms,” explained Ulloa. (startups latam)

Cryptocurrency Law Advances in Brazil

The Central Bank of this country shared information about the regulations it plans to establish for digital currencies in Brazil in 2024.

Avoiding directly regulating P2P transactions. The Central Bank highlighted the intention to avoid directly regulating peer-to-peer (P2P) transactions and proposed specific measures for banks, exchanges, DeFi, and Dex platforms.

About the regulation. “There is no case of pure DeFi that works without a company or entity managing governance, not even in DAOs. Therefore, if there is a company or responsible party, this protocol must comply with the established rules, and we are attentive to how to implement it,” said Antônio Marcos Guimarães, consultant at the Financial System Regulation Department. (Tekios)

Despegar opens physical stores in LATAM

Digital native companies are venturing into opening physical establishments in various sectors of the Latin American economy, as is the case with the Despegar group in the tourism industry.

About Despegar. Despegar, a travel company based in Buenos Aires, founded in 1999 by Roberto Souviron, evolved into a group that includes Best Day, Viajes Falabella, and Koin.

Despegar’s physical stores. Despite its digital origin, Despegar.com, one of the leading tourism firms in Latin America, opened four branches in Argentina and 10 physical stores in Brazil.

Company highlights. Although 40.1% of transactions continue to be made through Despegar’s applications, 15% of gross bookings, reaching 1.4 billion in 2022, were made in person. (Infobae)

Wited EdTech Targets Student Engagement in Mexico with AI-Enhanced Online Learning and Reward System

Wited is addressing low motivation levels among primary and secondary students in Mexico. The low motivation levels among primary and secondary students in the country can be attributed to the unchanged learning model over the years.

Value proposition. The company offers an online learning model that incorporates the Pomodoro technique, multimedia elements, and student participation to improve the education experience.

About the program. The program includes theoretical content, exercises, AI-analyzed exams, and live classes from selected teachers. Students can earn virtual coins as rewards for achievements. (Contxto)

Bird Electric Scooters Declare Bankruptcy Amid Market Struggles

Micromobility firm faces financial restructuring after NYSE delisting due to the company's stock value declining significantly. Despite the bankruptcy, Bird will continue with his operations.

Bird’s problems. Bird's CEO departed earlier in the year, and the company recently underwent layoffs. Bird aims to sell its assets to maximize value recovery.

Canada and Europe operations are not affected. The bankruptcy filing does not include Bird's operations in Canada and Europe.

LatAm’s operations. Bird’s expansion into Latin America began in 2018 with the launch of electric scooters in Mexico City, marking the company’s entry into the region. However, in the following years, Bird reduced their operations in Latin America. (Contxto)

Finds

tools, websites, and accessories

SheetAI. SheetAI is a powerful tool that allows users to leverage AI capabilities within their spreadsheets, enabling tasks such as data sanitization, text generation, and value prediction.

Ubique. Ubique is an AI-powered platform that uses advanced algorithms to synchronize lip movements and mimic the user's voice. It allows users to create videos with multiple dynamic variables.

Value Proposition Generator. The Value Proposition Generator provides a quick and free way for solopreneurs to turn their ideas into profitable businesses.

Food for Thought

The two sides of startup M&A: How to capture the good and mitigate the bad

The article discusses the opportunities and risks of mergers and acquisitions (M&A) in the technology startup industry. It emphasizes the importance of having a clear strategy and rationale for pursuing M&A, such as expanding customer relationships and increasing market reach.

M&A can also enhance a company's defensive positions and internal capabilities. The article highlights the role of price and deal structure in determining the success of an M&A deal, while also acknowledging the uncertainties and risks involved.

It suggests the need for a well-established playbook to guide the acquisition process and emphasizes the importance of value creation after the acquisition. The article mentions Thrasio's challenges in a competitive market dominated by Amazon as an example. ([99% Tech])

The author shares his personal experience of being fired from their job but being allowed to continue coming to work for two months, which they later realized was a mistake. Marc then discusses a recent situation where a company tried to sugarcoat the firing of one of its VPs by eliminating their position but allowing them to continue working for a month.

The author argues that such deception is unnecessary and ultimately detrimental to both the company and the employee. He emphasizes the importance of honesty and directness in handling such situations, as it shows respect for both parties involved.

Marc cites Netflix as an example of a company that prioritizes directness and personal responsibility in its corporate culture. (Marc’s Substack)

I'm Transforming My Startup Into An A.I. Startup – Here's Why.

The author, who works in dealing with business documents, initially had reservations about using AI in their line of business. They explain that while AI bots like ChatGPT and Claude can generate documents quickly, the quality is often inadequate.

Business documents require knowledge of the market, forecasting, and good designs, which are subjective and cannot be effectively replicated by AI. However, the author acknowledges that AI can be useful in terms of speed, such as conducting market research more efficiently. They propose a model where AI assists in co-creating valuable documents.

The author plans to showcase their findings and release an AI tool in a few months. They invite readers to share their opinions on whether AI should be more of an assistant and if it currently fails to produce good business documents. (AI Anany)

Worthy Recommendations

Burn Rate: Launching a Startup and Losing My Mind, recommended by Ariela Safira, Founder and CEO of Real.

Burn Rate. “The most honest business book I’ve read to date, highlighting the real journey of founding a company,” Ariela says.

Jobs

Country Manager at Tesla (Mexico City, Mexico; On-Site)

Customer Experience Manager, SSD at Tesla (Puebla, Puebla, Mexico; On-Site)

Field HR Lead, Mexico at Tesla (Monterrey, Nuevo León, Mexico; On-Site)

Indirect Procurement Manager at Tesla (San Pedro Garza García, Nuevo León, Mexico; On-Site)

Warehouse Supervisor, supply chain at Tesla (Querétaro, Querétaro, Mexico; On-Site)

Deals

These startups and companies received capital this week:

Visa/Prosa | Payments | M&A. Visa is acquiring a majority stake in Mexican payments processor Prosa to expand digital payment adoption in Mexico. Prosa will continue to operate independently but will benefit from Visa's global network and expertise.

Cáscara Foods | Foodtech | Crowdfunding. Cáscara Foods has raised USD$350,000 through the crowdfunding platform Broota, known for supporting startups like Babytuto, Khipu, SocialLab, and Algramo. The startup stands out for its approach to transforming food waste into edible products like shakes and healthy supplements, employing upcycling practices in the food industry.

Bankme | Fintech | Seed. Brazilian credit infrastructure fintech Bankme has raised R$7.4m ($1.3m) in funding from venture capital manager DOMO.VC. The funds will be used to develop a new product called Redesconto and Aporte.

Credmei | Fintech | Debt Financing. CredMei, a fintech specializing in anticipating receivables for small and medium-sized enterprises (SMEs), has announced a R$40 million debenture with Credix, a marketplace for loans through decentralized finance. The funding will be used to speed up the granting of credit to SMEs in Brazil, particularly those in the agribusiness, industrial, and distribution sectors.

Mercado de Recebíveis | Fintech | Seed. The newly established fintech company, recently concluded its inaugural investment round, achieving a valuation of USD$14 million. The round was spearheaded by Urca Angels and included notable participants like Inês Corrêa Souza of Magalu’s board and Letsbank’s executive director Marcelo Bella.

Carryt/Liftit | Delivery | M&A. Carryt, a Chilean delivery startup, acquires Liftit in Brazil for USD$800,000, aiming for $13 Million Revenue in 2023. The company plans to expand its geographic coverage, use purchase analytics for marketing campaigns, and transform local stores into fulfillment points.

Blueberries Medical Co. | Pharma | Post-IPO Equity. Colombian supplier of cannabis-derived ingredients to businesses of all sizes Blueberries Medical Co. raised CA$2,000,000 from Terraflos Inc. The startup develops and commercializes cannabis-derived ingredients with THC content according to the regulations of the desired application.

Invenio Capital Partners | Private Equity | Seed. Mexican search fund Invenio Capital Partners just raised USD$500,000 in a seed round. Lead by Germán Liz, Invenio Capital Partners seeks to acquire, operate and grow a single exceptional business. The firm is seeking for profitable businesses (+$.15 million in EBITDA) with owners considering a transition.

Solvento | Fintech | Debt Financing. Solvento, a fintech platform focused on lending to the logistics sector, obtains US$50 million for credit in the transportation sector. The funds will be used to develop and expand the firm, particularly to meet the growing demand for financing and technological tools in the sector.

NEORIS/ForeFront | Accelerator | M&A. Global digital acceleration leader NEORIS has completed its acquisition of ForeFront, a Salesforce partner specializing in cloud consultancy and implementation services. The acquisition aims to strengthen NEORIS's presence in the American market and enhance its consulting capabilities in various sectors.

Sensify | AI/Data | Not specified. Argentinian startup Sensify has received an investment from Kamay Ventures, a corporate fund by Arcor and Coca-Cola. Sensify uses AI and big data to address food retail industry issues, particularly food loss prevention in the cold chain and consumer insights at sale points.