AWS Community Day Mexico was a success in Monterrey

More about WeWork's bankruptcy. The real valuation of Kavak. 80% of IPOs Since 2020 Are “Broken”. Your employees are not your family. Peru hosts Venture Capital Conference 2023.

Welcome to our weekly newsletter covering the latest news and trends in the Latin American startup scene.

AWS Community Day Mexico was a success in Monterrey

The first edition of AWS Community Day Mexico took place in Monterrey and was a success. The event aimed to bring together AWS enthusiasts and provide them with opportunities to learn, share, and grow.

Over 380 attendees participated in over 30 conferences and workshops, covering various AWS technologies. The event highlighted the growing impact of AWS Community in Latin America, with a presence in 16 countries and 52 user groups.

Women played a significant role, with 80% female representation in the event's organization. The event provided training, networking, and certification opportunities, with 25% of attendees being women.

Vía Contxto

WeWork declares bankruptcy and begins restructuring process to revitalize its business

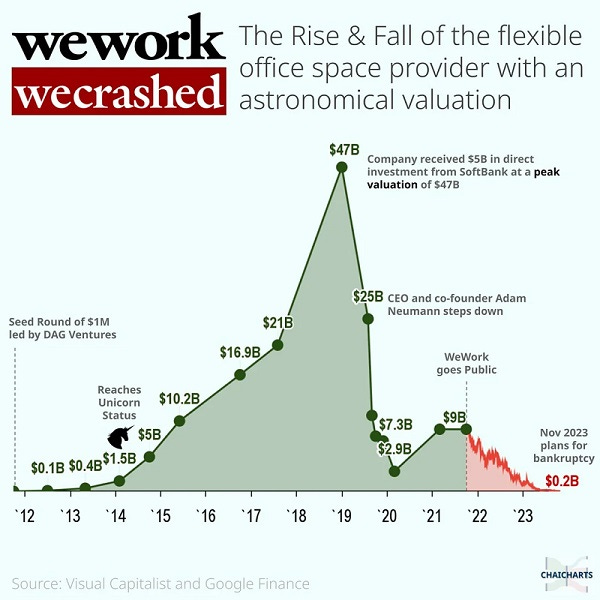

WeWork, the office rental and coworking space company, has filed for bankruptcy in the United States after failing to make interest payments on its debt. The company has reached a restructuring agreement with its creditors to reduce debt and expedite the process.

WeWork plans to focus on business continuity by rationalizing its lease portfolio. The company's locations outside the US and Canada are not included in the bankruptcy process. The CEO of WeWork remains optimistic about the company's future and its leadership in the flexible work sector.

Despite the bankruptcy, WeWork will continue to provide services to its members and expects to have the necessary financial liquidity to maintain operations. This bankruptcy is a significant setback for WeWork, which was once valued at nearly USD$47 billion and considered a unicorn startup.

Vía Contxto

Kavak, ¿kaput?

Kavak has decided to close its operations in Colombia and Peru and focus on more profitable and growing markets like Mexico, Brazil, Argentina, and Chile.

This decision comes as Kavak faces challenges such as negative user feedback, economic conditions affecting the automotive market, and fierce competition in Brazil.

While the exact valuation of Kavak is unknown, a comparison with Carvana, a similar company in the US, suggests that Kavak's estimated value could be around USD $1.07 billion. However, Kavak's success relies on improving its user experience and customer service. If it fails to do so, it may face difficulties in the future.

Vía LinkedIn

Quick News

NotCo introduces new products for coffee lovers

NotCo, a global foodtech company, has launched two new products aimed at impacting the coffee industry: Why Not Barista Club and NotMilk Barista Club.

Value proposition. The club aims to strengthen the bond between the company and baristas, offering exclusive experiences and specialized knowledge.

The announcement. The product offers a thick and consistent cream, versatile for various preparations. The launches were presented at an exclusive event in São Paulo, including a Latte Art competition. (Contxto)

Liquido licensed to operate as a payment institution in Brazil

Liquido, a US-based fintech founded by Chinese citizens, has obtained a license from the Central Bank to operate as a payment entity in Brazil. The company, which focuses on the needs of Latin America, can now compete globally.

Highlights. Liquido already conducts transactions worth USD $1 billion annually in Brazil and operates in Mexico, Colombia, and Chile.

A new path With the new license, it plans to serve customers directly and offer its WhatsApp e-commerce solution without intermediaries. (Contxto)

Women in Tech promotes women’s leadership in the sector

The third edition of the Women in Tech event, organized by Xepelin, will highlight the contributions of women in the technology industry.

Why it matters. The event aims to inspire more women to pursue careers in tech and will feature prominent figures such as Teresa Ripamonti, Francisca Varela, and Alice Martins.

Save the day. The event will take place on December 6th and will be live-streamed on Xepelin's social media platforms. (Contxto)

Sodexo launches its fintech Pluxee to expand in Mexico

Sodexo, a multinational food services company, has chosen Mexico as its entry point into the fintech sector.

Highlights. It plans to test its solution, Pluxee, in Mexico and aims to become a comprehensive provider of corporate solutions. Pluxee will offer financial, incentive, and administrative services.

The market in Mexico. Pluxee has obtained authorization to operate as a fintech in Mexico and will launch two products: one for managing allowances for workers and another for customizing employee benefits. (Contxto)

Ebury, European fintech, arrives in Chile with expansion plans in LatAm and growth projects for SMEs

London-based fintech company Ebury has launched operations in Chile, aiming to strengthen its presence in Latin America.

Business model. Ebury specializes in international payment and collection services, and currency risk management, and serves small and medium-sized enterprises.

Why Chile and Latam. The company anticipates significant growth in Chile and may consider using the country as a base for regional expansion. The entry of Ebury into Chile highlights the country's rising importance in the Latin American fintech industry and provides local businesses with new tools for managing international financial operations. (Contxto)

AstraZeneca Mexico launches the first Open Challenge to boost health sector startups

AstraZeneca Mexico has launched the first Open Challenge as part of Mexico's Health Innovation Hub.

About the challenge. The challenge aims to improve patients' quality of life through early prevention, diagnosis, and treatment using innovative technologies and processes.

Value proposition. The competition, in collaboration with Brixton Ventures Labs, focuses on oncology, cardiorenal-metabolic diseases, and rare diseases. Winners will receive financial support, technological perks, and mentorship, with the opportunity to integrate their solutions into the healthcare system. (Contxto)

Smart Flux revolutionizes and digitalizes maritime operations

Smart Flux, a system that digitizes the release process of import containers, was officially presented by Matthew Taylor Pollmann, the general manager of Flux.

About the system. The system can adapt to various local realities, integrate with other applications, and provide complete visibility into the container's status and load. Although not launched yet, Smart Flux has been successfully implemented by Ian Taylor and its associated shipping companies to digitize the container release process in Chile.

About Smart Flux. Smart Flux improves visibility and control for shipping companies, optimizes billing for ship agents, streamlines clearances for customs agents, and reduces the risk of delays for importers. It also contributes to environmental sustainability by eliminating paper usage and reducing carbon footprint. (Contxto)

German Accelerator launches its first Hub in Buenos Aires to boost German startups in LatAm

German Accelerator, an initiative to support German startups in expanding globally, has opened an office in Buenos Aires, Argentina.

Why Buenos Aires? This move aims to enhance the innovative capacity of German startups by providing them access to resources and connections in Latin America.

Highlights. The office will serve as a hub in the region, introducing startups to opportunities and characteristics of the market. It will also foster cooperation and knowledge exchange between Germany and Argentina. (Contxto)

WiPay Group expands to Colombia launching inclusive financial solutions

WiPay Group, a Caribbean fintech company, is expanding into the Colombian market to revolutionize the financial services sector, particularly for underserved communities like the Afro-Colombian community.

Value proposition. WiPay Colombia aims to offer accessible financial tools through its COLOUR mobile app, including digital bank accounts, virtual Visa cards, bill payments, mobile top-ups, and microloans.

Why it is important. WiPay's goal is to promote financial independence and economic growth for marginalized communities. (Contxto)

Peru hosts Venture Capital Conference 2023 to transform and boost LatAm startups

Peru is hosting the Venture Capital Conference 2023 to drive the startup ecosystem in the region. Investment in Peruvian startups has seen impressive growth, with over USD $300 million invested in the last three years, six times more than the previous three years.

About the conference. The Peru Venture Capital Conference will bring together entrepreneurs, startups, investors, and business leaders to discuss current trends in venture capital, impact investment, and gender diversity.

Speakers. Among the notable speakers will be Elizabeth Yin from Hustle Fund, Brian Requarth from Latitud and Shark Tank Mexico, Greg Horowitt, a renowned investor and author, Carolina Huaranca from First Close Partners, Rogelio de Los Santos from Dalus Capital, and Daniella Raffo from VelezReyes+, representative of the founder’s foundation of Nubank, among others. (Contxto)

Finds

tools, websites, and accessories

Shortform. Shortform guides provide concise and clear explanations of complex ideas from popular books, making them an efficient and valuable learning resource.

Opinly.ai. Opinly.ai is a tool that offers real-time competitor analysis for companies. By inputting a competitor's YouTube link, Opinly.ai generates a comprehensive report on their performance, including pricing changes, metrics, and plan options.

Braintrust. Braintrust provides a comprehensive platform for evaluating, logging, and visualizing outputs of AI systems, making it easier to track performance and make improvements.

Food for Thought

Three human mistakes VCs often make, and how understanding them can help entrepreneurs fundraise bet

Venture capitalists often talk about their successes but rarely discuss their failures. However, there are non-economic mistakes made by VCs that are often overlooked. One important factor is the personal connection between the investor and the founder.

VCs are more likely to support a founder they feel a personal connection with, even if their numbers and products are not as good. This bond can be formed through shared interests or backgrounds. On the other hand, if the person feels like a stranger, the amygdala in our brain activates, and our survival instinct kicks in.

To counter these biases, VC funds have multiple partners with different personalities. Entrepreneurs should take the time to learn about the human side of investors before pitching their startups. Understanding their preferences and interests can help determine who to approach. (Bundle)

80% of IPOs Since 2020 Are “Broken”

The Wall Street Journal (WSJ) recently reported that 80% of IPOs since 2020 are trading below their initial offering price. This is concerning because when investors don't make money from startups, it slows down the entire investment process.

Most venture capital investments need to make money, even at the seed stage. The fact that the majority of IPOs aren't profitable, including recent ones from successful companies like Klaviyo, Instacart, and ARM, is causing stress in the startup ecosystem.

Repricing may help solve this issue, but it takes time and can be painful. If the IPO market continues to underperform, it will have a ripple effect on the entire startup industry. (SaaStr)

The article argues against the idea of treating a company like a family and instead suggests viewing it as a sports team.

Marc Randolph, former CEO of Netflix, explains that the responsibility is to field the best team and ensure everyone excels in their positions.

In startups, where team members may change frequently, it can be difficult to let someone go. However, if the goal is to build a successful team, making tough decisions becomes necessary. (Marc’s Substack)

Worthy Recommendations

Unscripted: The Epic Battle for a Media Empire and the Redstone Family Legacy, recommended by Mansueto Ventures’ CEO & CCO Stephanie Mehta

Unscripted. “Unscripted offers a deeply reported account of the greed, drama, and misconduct that pervaded the final years at Sumner Redstone's media companies, CBS and Viacom.”, Mehta says.

Jobs

Top Deal Hunter at Rappi (Mexico City, Mexico; On-Site)

Vicepresidente de Marketing at Marble Headhunter (Bogota, D.C., Capital District, Colombia; On-site)

Senior Consult Partner at Kyndryl (Mexico City, Mexico; not specified)

Visa Product and Innovation Talent Community Mexico at Visa (Mexico City, Mexico; Hybrid)

Líder Innovación y Desarrollo at Holcim Mexico (Mexico City, Mexico; Hybrid)

Deals

These startups and companies received capital this week:

Hapi | Trading Platforms | Seed. San Francisco-based company Hapi, with Peruvian roots, has raised $1.6 million in funding to strengthen its presence in the Latin American stock market. The funding came from various investment entities, including Utec Ventures and Softeq Ventures.

Beetransfer/Bitso | Fintech | Partnership. Fintech startup Beetransfer has formed a strategic partnership with cryptocurrency platform Bitso to accelerate its expansion in Latin America. The collaboration will allow Beetransfer users to receive instant payments in their local currency, providing greater flexibility.

GoPass | Fintech | Not specified. Colombian payment platform for toll booths and other services GoPass, closed a USD $15 million funding round led by Kaszek Ventures. The investment will be used to acquire more clients and digitize payment processes.

CondoConta | Fintech | Series A. Brazilian fintech CondoConta has raised approximately USD$14.6 million in its Series A funding round. The investment, led by SYN Proptech, Endeavor Scale-Up, and Terracotta Ventures, aims to strengthen CondoConta's position in the Brazilian condominium market.

QI Tech/Singulare | Fintech | M&A. Brazilian fintech QI Tech has acquired Singulare, one of the main stock brokers in Brazil, in a deal whose terms were not disclosed. The acquisition is pending approval from the Central Bank and the Administrative Council for Economic Defense.

Cuby Smart | HVAC | Competition. Mexican startup Cuby Smart has won the Airtech Challenge, a regional competition for innovative projects in the HVAC industry. Cuby Smart is a device developed by Arteco Electronics that improves the energy efficiency of air conditioners without compromising user comfort.

Medina Ventures | VC | Fund. Miami-based venture capital company Medina Ventures is currently raising funds for its first dedicated fund to invest in startups in Latin America and the United States. The company was launched in August of this year but its founders and executives have a strong background in innovation and entrepreneurship.

Del Lago Capital | Search fund | Seed. Colombian search fund Del Lago Capital raised USD $315,000 in a seed round. The search fund is seeking to acquire a successful company in order to accelerate its growth while preserving its legacy, reputation, and brand.

Eurofarma Ventures | VC | Fund. Brazilian pharmaceutical company Eurofarma has launched a corporate venture capital fund called Eurofarma Ventures, with plans to invest up to USD$100 million in early-stage biotech startups. The fund aims to collaborate with startups that are adopting disruptive approaches in the field of biotechnology and pharmaceutical research.

InDrive | Mobility | Fund. Global mobility platform InDrive has launched a new division called New Ventures, which will allocate up to USD $100 million in investments to startups in emerging markets. The division will focus on regions such as Latin America, the Middle East, Africa, Southeast Asia, and Central Asia. Startups in the post-seed/Series A stage with substantial year-over-year growth and healthy economics will be considered for investment.